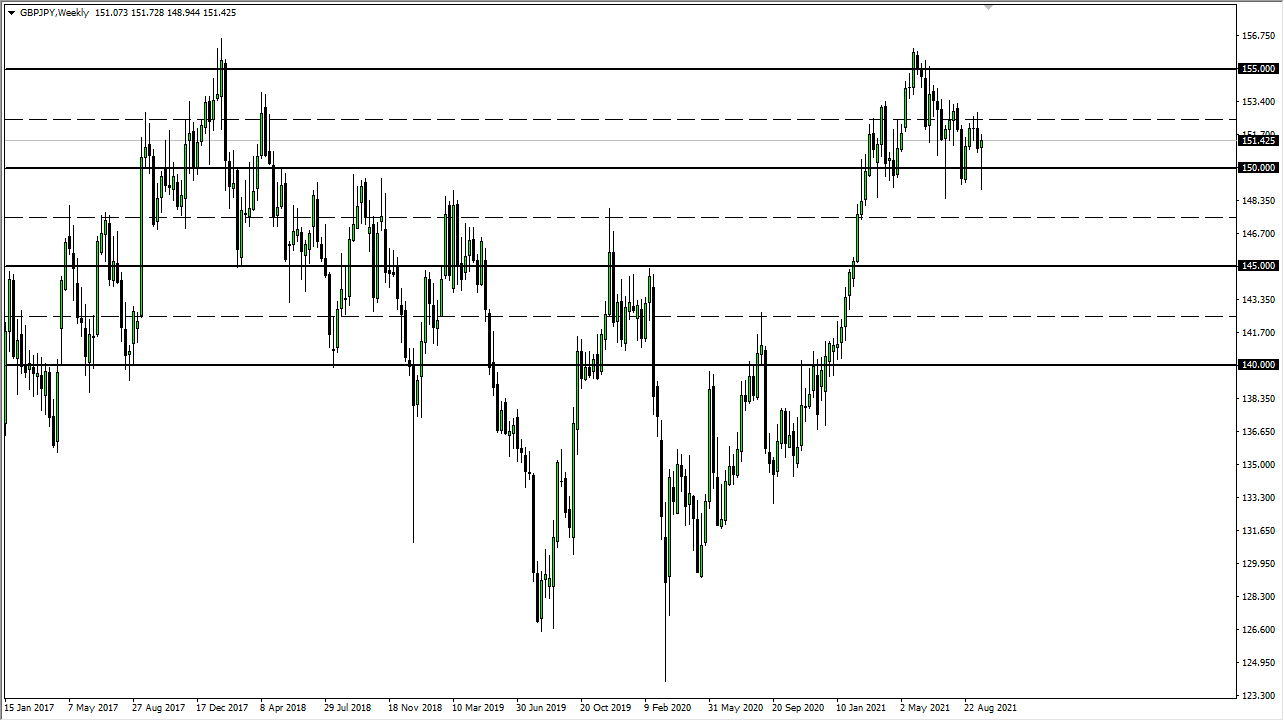

GBP/JPY

The British pound fell significantly during the last trading week, but then turned around to show signs of life at the ¥149 level. The market has turned around to form a bit of a hammer, and now it looks like we are trying to break out to the upside. That being said, the ¥153 level been broken to the upside is what needs to be seen in order to get overly bullish. In the meantime, I anticipate that we will have a lot of choppy behavior, based mainly upon the idea of risk appetite either being on or off.

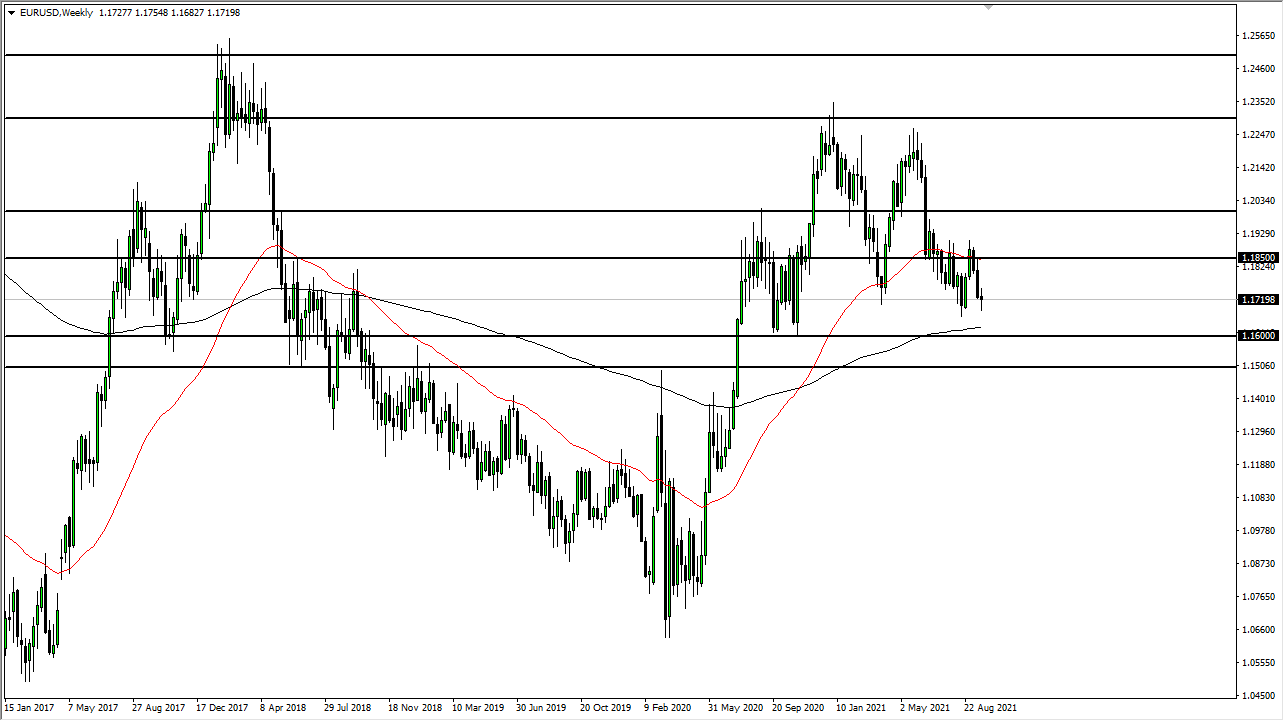

EUR/USD

The euro fluctuated last week to show signs of confusion, with the 1.1685 level underneath offering support. If we break down below that level, then I believe that the euro will sell off quite drastically to open up a move down towards the 200-week EMA. That being said, this is a market that seems to be somewhat consolidating, and if we break above the top of the weekly candlestick, we could go looking towards 1.1850 level above. At this point, I think the market will stay in this tight range that we have been in for a while.

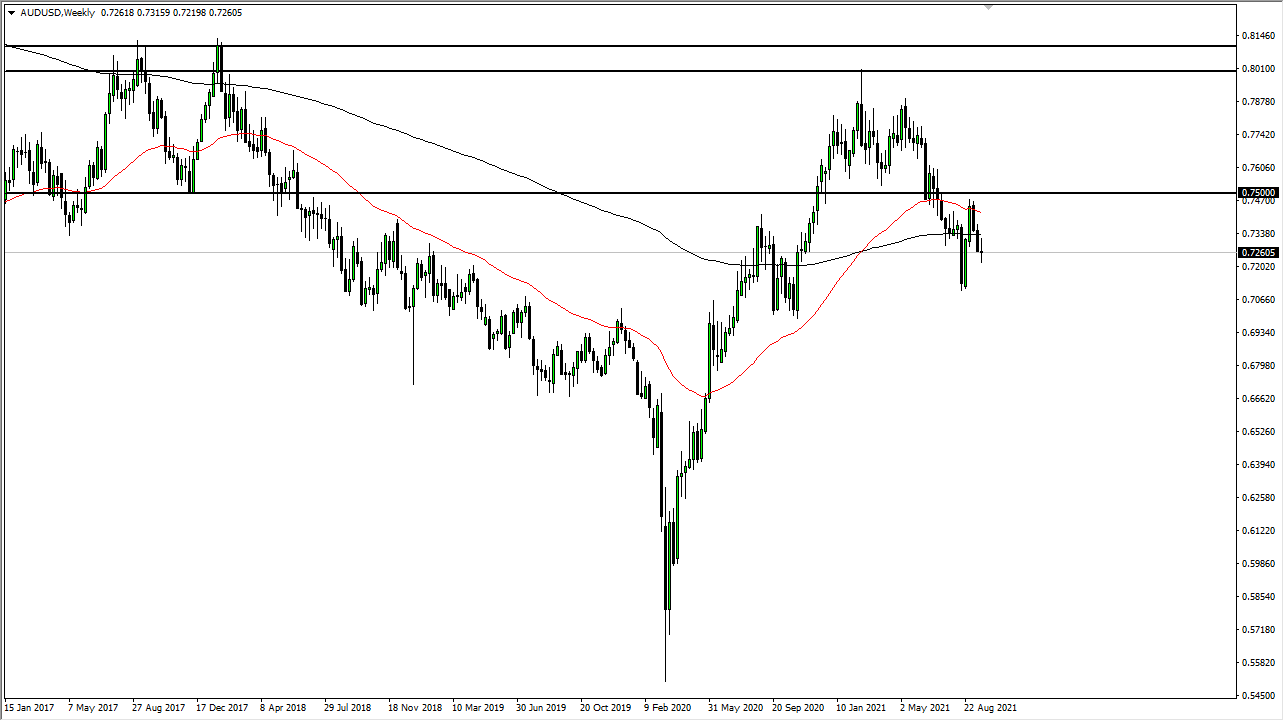

AUD/USD

The Australian dollar went gone back and forth last week as we continue to hear a lot of noise in this pair. That being said, the market is likely to make a decision based upon which side of this candlestick we break out of. If we break down below the bottom of the candlestick, it is likely we will go looking towards the 0.71 level. On the other hand, if we break above the top of the weekly candlestick, then it is likely we will go looking towards the 0.7450 level. Keep in mind that the Australian dollar is highly sensitive to the risk appetite of traders around the world and everything going on in China.

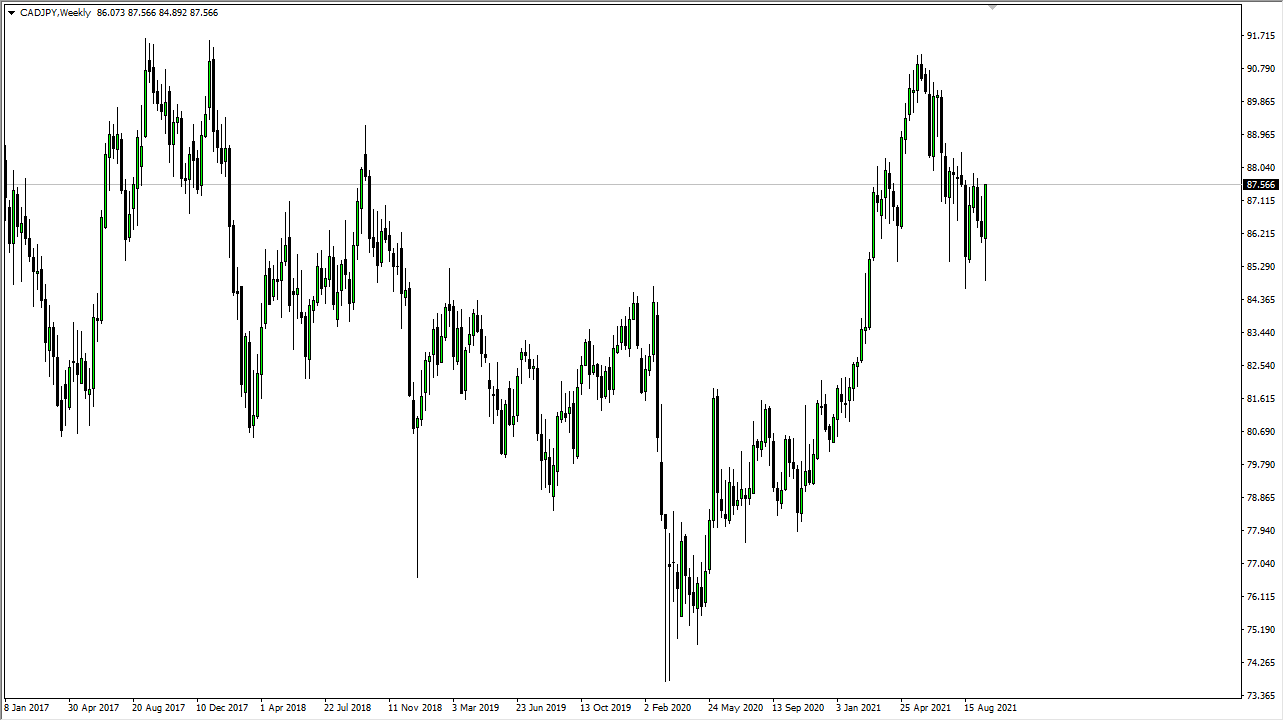

CAD/JPY

The Canadian dollar initially fell during the course of last week, but then turned around at the ¥85 level to show signs of strength. Furthermore, you should keep an eye on the oil market as it looks like it is trying to break out to the upside. If oil continues to rally the way it has been, then it is likely that the Canadian dollar could go looking towards the ¥90 level over the longer term. On the other hand, if we turn around and show signs of exhaustion, then we could go looking towards the ¥86 level initially before reaching towards the bottom of the candlestick.