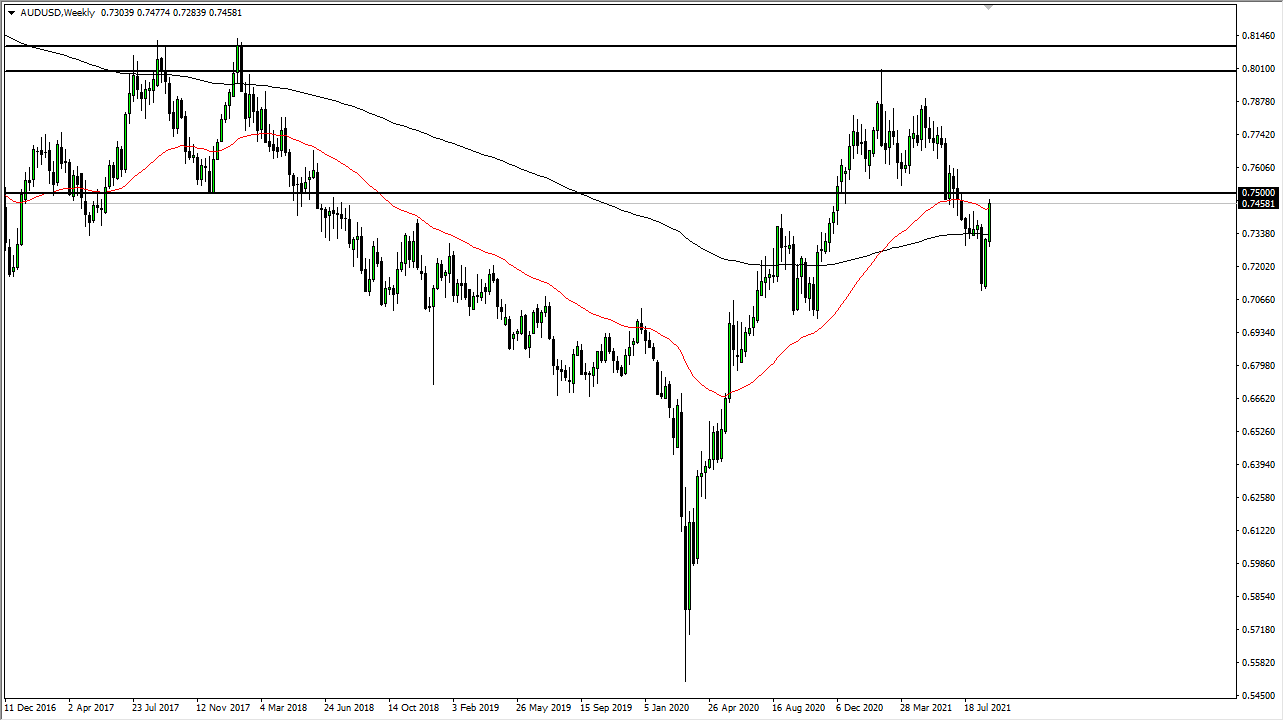

AUD/USD

The Australian dollar rocketed higher last week as the GDP figures from Canberra were much stronger than anticipated. At this point, I think the market is going to make a serious test of the 0.75 handle, and on a daily close above that level I would think that the market has further to go, perhaps reaching towards the 0.77 handle. On the other hand, if we were to break down below the 200-day EMA again, it is possible that we fall towards the 0.71 handle.

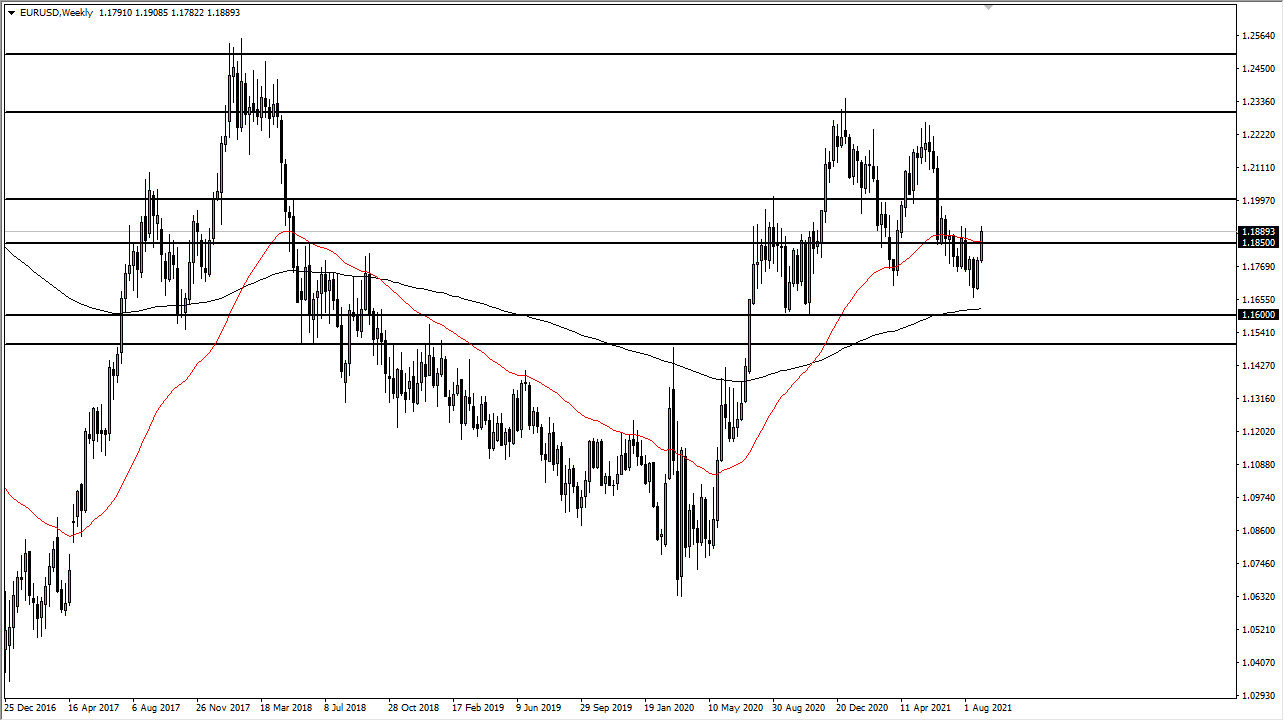

EUR/USD

The euro rallied significantly last week to test the 1.19 level. The 1.19 level has been a significant resistance barrier, and now I think the market will probably continue to see the area as difficult to get above. But if we do get above it, then I think it is only a matter of time before the euro goes looking towards the 1.20 handle on a breakout. However, if we turn around and break down below the 1.1850 level, then it is very likely that the market will go looking towards the 1.17 level. This will be all about the US dollar more than anything else.

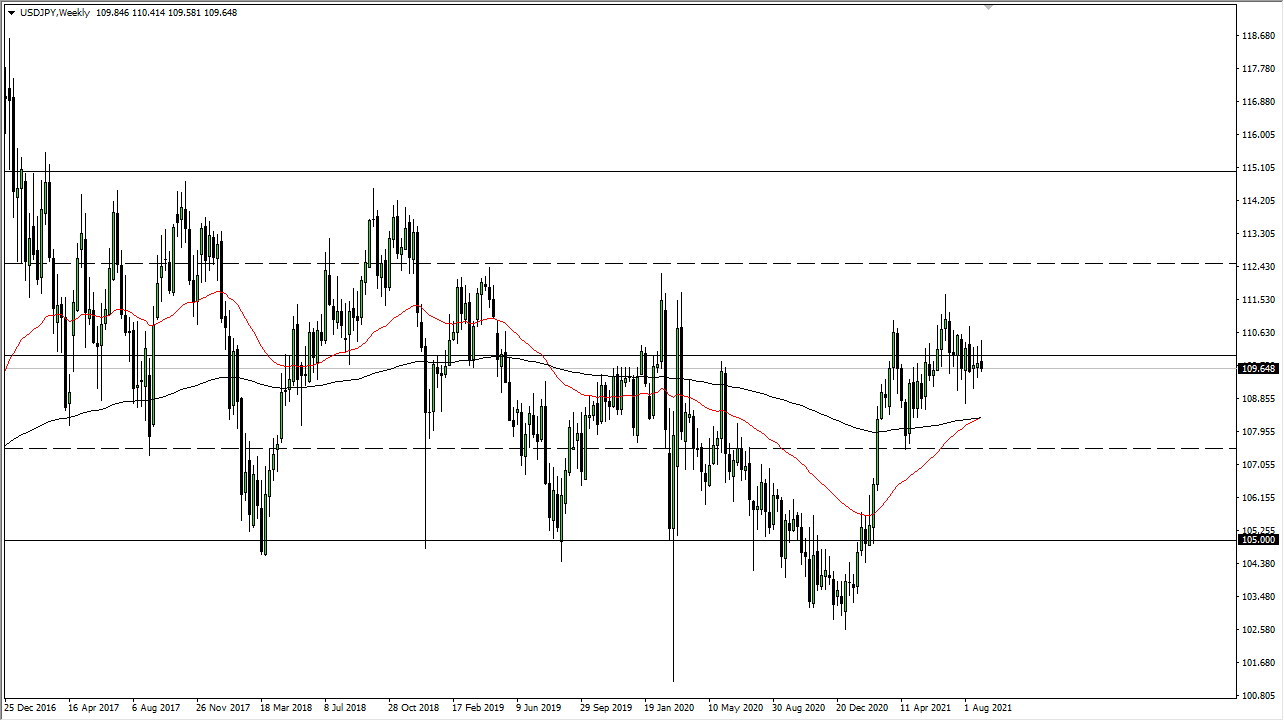

USD/JPY

The US dollar gave back early gains against the Japanese yen as the ¥110 level continues to offer resistance. By turning around the way it has, it looks as if the market will continue to favor selling pressure more than anything else. The ¥109 level continues to offer support, so if we were to turn around and break down below there then it is likely that we could go looking towards the ¥107.50 level. On the other hand, if we were to turn around and break above the ¥110.75 level, then it is likely that the market could break out towards the ¥112 level after that.

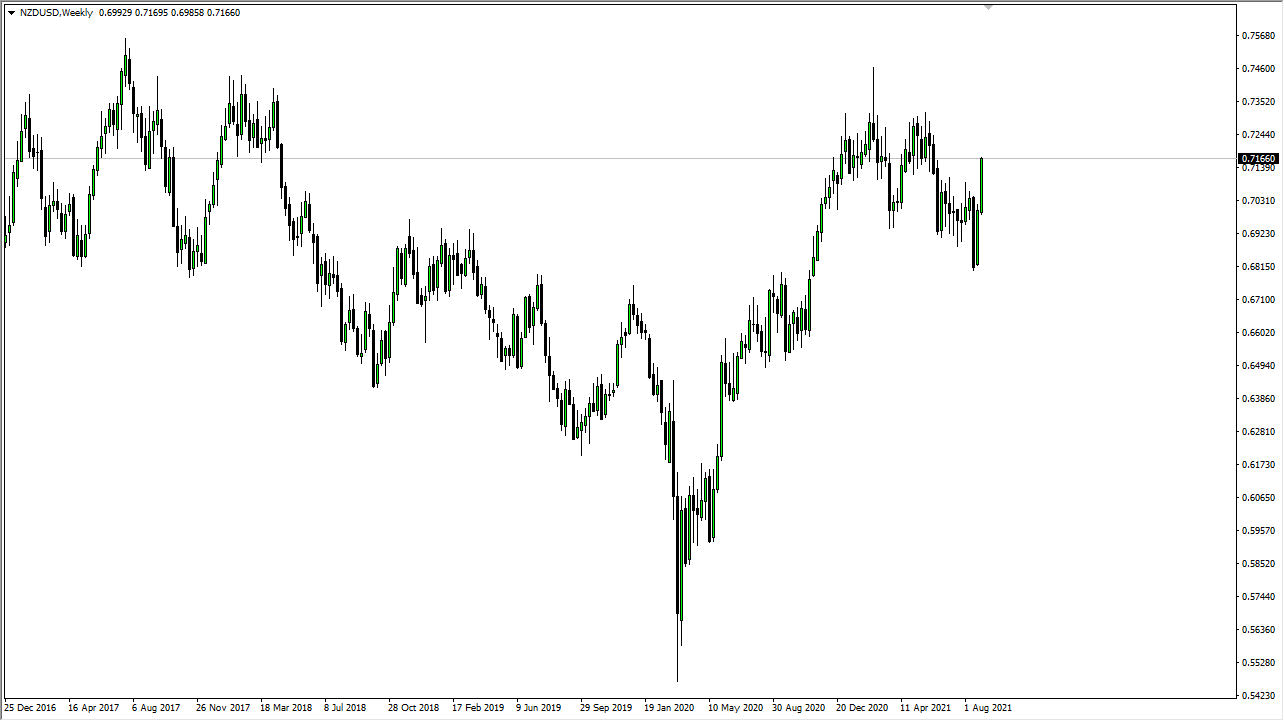

NZD/USD

The New Zealand dollar rallied quite a bit during the week, and it now looks as if it is going to test the 0.72 handle. Pay close attention to the US Dollar Index because I think this is more or less going to be an indictment on the US dollar overall. Pullbacks at this point should continue to see plenty of buying opportunities, at least until we break down below the 0.69 level, which is an area where we have seen plenty of buyers over the last couple of weeks.