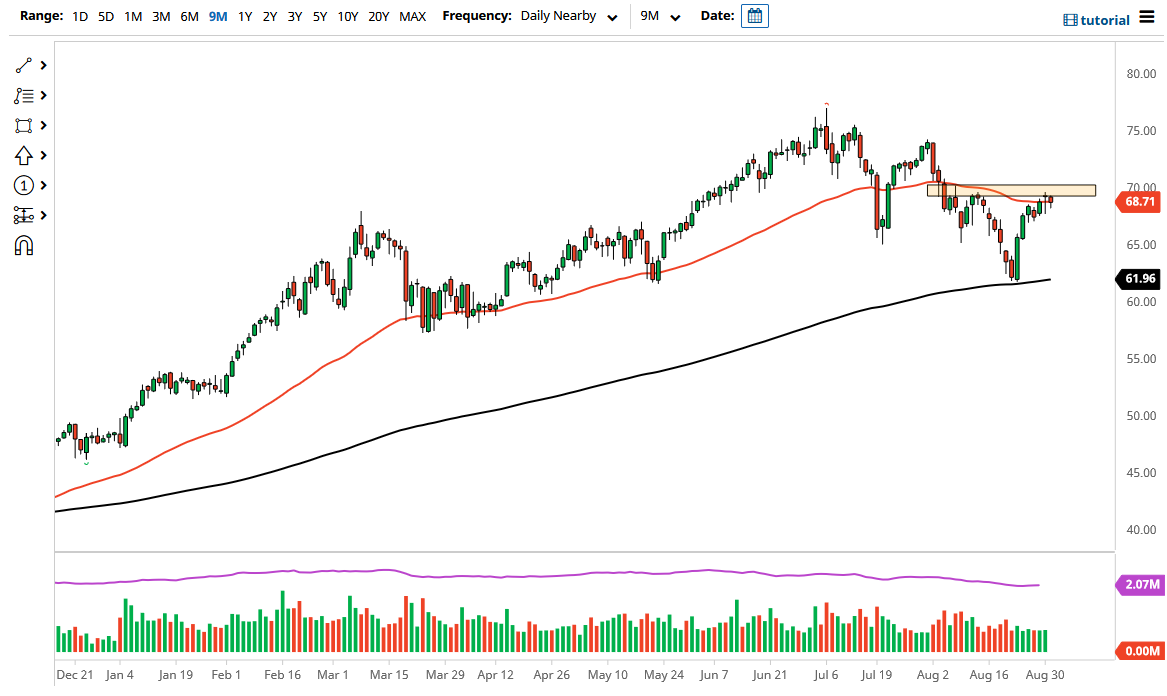

The West Texas Intermediate Crude Oil market pulled back just a bit on Tuesday, but then showed signs of life again as the 50-day EMA continues to attract a certain amount of trading orders. The $70 level above continues to be a significant resistance barrier, so I think that if we get above there, that would be a very strong sign and perhaps send this market looking towards the $74 level. On the other hand, if we were to turn around and break down below the lows of the session on Monday, that could open up fresh selling.

If we do get that breakdown, the market is probably going to go looking towards the $65 level, which is an area that has caused a bit of support multiple times in the past, but we did most recently break through it on the dip. The 200-day EMA underneath is sitting at the $62 level, so if we do fall towards $65, it is likely that we could go looking lower. Breaking down below that would kick off a fresh negative turn of events, and as a result we would see fresh selling and significant negativity.

If we do break above the $70 level, I think that the move to the $74 level could be somewhat significant and relatively quick. That being said, we are waiting to see whether or not OPEC is going to raise production output sometime in the next several days, so that could give us a little bit of a negative catalyst, but at the same time we have the hurricane damage in the Gulf of Mexico, which is still being sorted through, but it was not such a complete disaster to refining that people had thought it could be.

When we look at this market, you can see that a move above the $70 would be a “higher high”, which would be the beginning of a potential uptrend. I think that in the next couple of days we should get an idea of whether or not this was a simple pullback in a longer-term uptrend, or if it is the beginning of something bigger. I would anticipate a lot of volatility this week, especially as we get closer to Friday as we will have not only gotten past OPEC, but then we would be looking at the jobs figures in America.