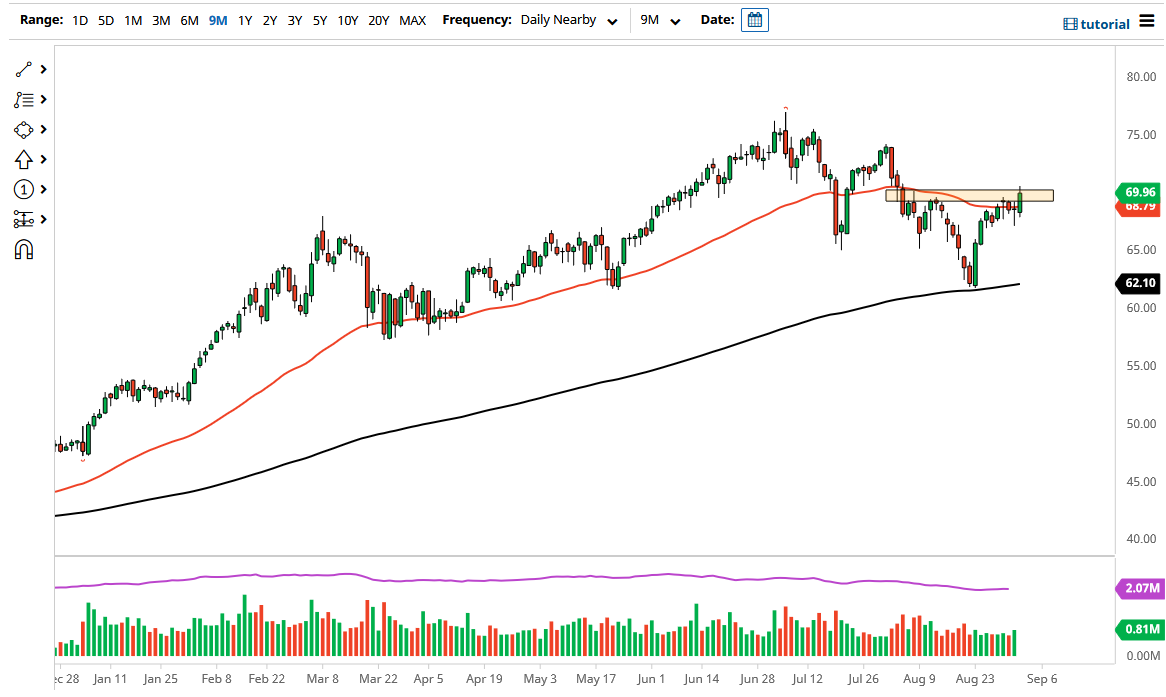

The West Texas Intermediate Crude Oil market has broken higher during the course of the trading session on Thursday as we broke above the $70 level. That is an area that I have been talking about for a while, and the fact that we broke above there is a very good sign and it is likely that we could go looking towards the $74 level. The $74 level is an area where we have sold off drastically in the past, and as a result it looks like we are going to continue to see that as important.

On the other hand, we could turn back around and go looking towards the 50 day EMA underneath, which is near the $60.75 level. That is an area that I think could offer quite a bit of support, and therefore think it is only a matter of time before the buyers would come back into that area. At this point in time, the $67 level is an area that has been support during the previous session, as well as many other days. As long as we can stay above the $67 level then it is likely that we will continue to go higher. However, breaking down below that level would open up a completely different scenario.

If we were to break down below the $67 level, then it is likely that the market would fall towards the $65 level, possibly even the 200 day EMA after that. When I look at this chart, that could very well be what happens next, but once we get past the jobs number will have a quite a bit more in the way of clarity, so therefore it is worth paying attention to how things end up at the end of the session. I feel at this point time we are at the precipice of some type of bigger move, so it is interesting to see how the market plays out at the end of the day.

The size of the candlestick is relatively impressive, although I do not necessarily think that it is an explosive move to the upside. If we can break above the top of the candlestick, then it is likely that we go much higher. Ultimately, this is a market that looks like we are going to see volatility coming soon. In that scenario, the end of the day on Friday is crucial.