Bullish View

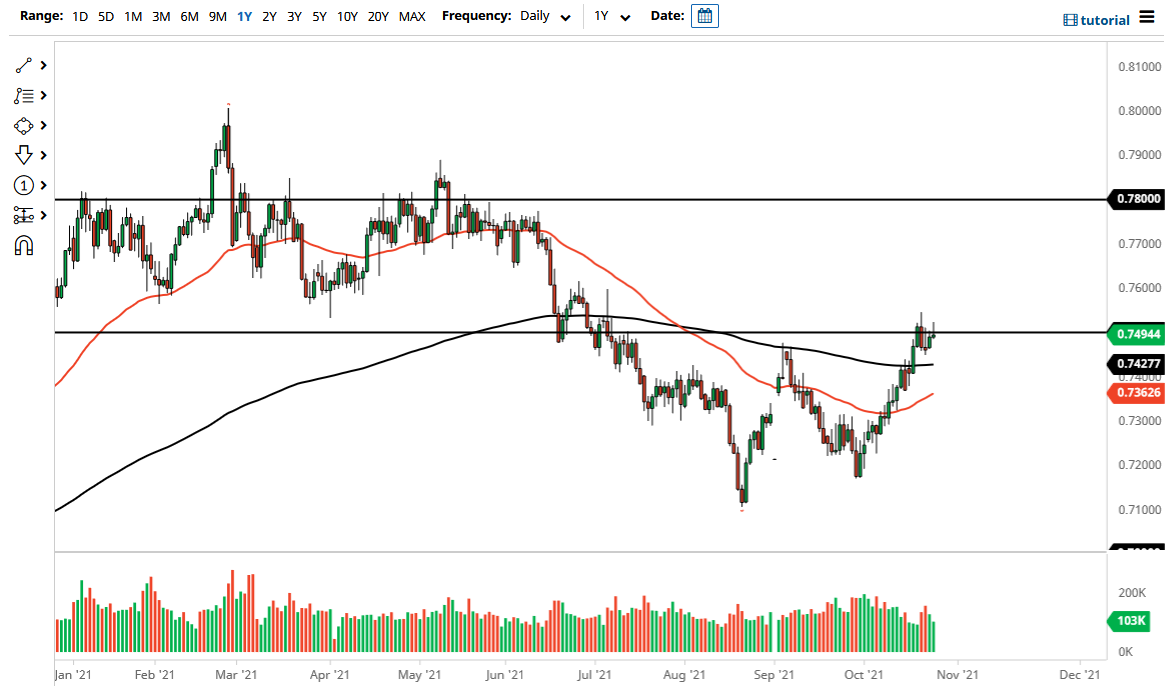

Buy the AUD/USD pair and set a take-profit at 0.7600.

Add a stop-loss at 0.7450.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 0.7500 and a take-profit at 0.7400.

Add a stop-loss at 0.7600.

The AUD/USD pair rose for the third straight day as investors reacted to the latest Australian consumer inflation data. The pair rose to a high of 0.7522, which was significantly higher than this month’s low of 0.7170.

Australia Inflation Data

The AUD/USD rose in early trading after data by the Australian Bureau of Statistics (ABS) showed that consumer inflation rose by 3.0% in the third quarter after rising by 3.8% in the previous quarter. The increase was slightly lower than the median estimate of 3.1%. On a QoQ basis, consumer prices rose by 0.8%.

Meanwhile, the trimmed-mean CPI rose from 1.6% to 2.1% while the weighted mean rose from 1.7% to 2.1%. These numbers were better than the median estimates of 1.8% and 1.9%, respectively. They also show that the country’s inflation is above the Reserve Bank of Australia (RBA) target of 2.0%.

Analysts expect that Australia’s inflation will remain above the target 2.0% because of the rising energy prices. In the past few weeks, the prices of crude oil has jumped to the highest level in eight years while natural gas has risen to an all-time high. These costs will likely be passed to consumers.

The AUD/USD pair also reacted to the strong Chinese industrial profits data. The numbers revealed that these profits rose from 10.1% in August to 16.30% in September. Chinese data is important for the Australian dollar because of the volume of trade between the two countries.

The pair also rose after the strong American consumer confidence data that was released on Tuesday. The data showed that confidence rose for the first time in three months in October. Later today, the pair will react to the latest US durable goods order numbers.

AUD/USD Forecast

The four-hour chart shows that the AUD/USD pair has been in a bullish trend in the past few days. The pair is trading at 0.7522, which is slightly below this month’s high of 0.7545. It has also moved slightly above the short and long-term moving averages. The pair has also moved above the key resistance level at 0.7478, which was the highest level in September. Therefore, the pair will likely keep rising as bulls target the key resistance level at 0.7600.