Today’s AUD/USD Signals

Risk 0.75%

Trades may only be entered 5pm Tokyo time Wednesday.

Short Trade Ideas

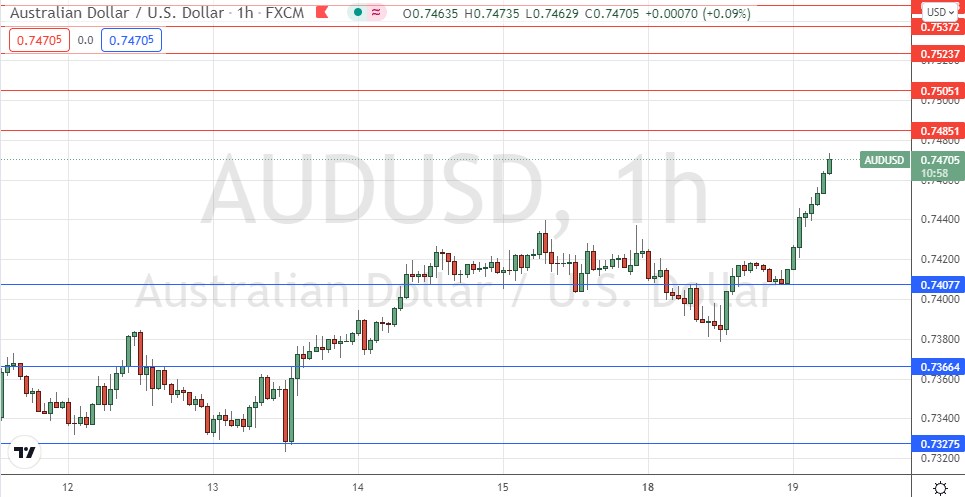

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7485, 0.7505, 0.7524, or 0.7537.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7408, 0.7366, or 0.7328.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

We have seen a powerful rise in the price of this currency pair over recent hours following the RBA Meeting Minutes release. The Australian dollar is the strongest major currency right now with the US dollar and Japanese yen the weakest ones, so AUD/USD and AUD/JPY are interesting to traders in the long direction.

The RBA Minutes showed that the RBA wants to see inflation stabilize at between 2% to 3% before hiking rates, and to keep monetary policy accommodative in the meantime. These are not logical reasons for the currency (here the AUD) to advance but the release has somehow triggered or at least accelerated the current bullish move.

Risk-on sentiment is dominating the market with stocks, many commodities, and Bitcoin rising firmly, and this is helping to boost the Australian dollar which has become the “risk” barometer in the Forex market.

Technically, the strength of the move is somewhat significant, but what is more significant is that the price is rising to a multi-week high, albeit not a major multi-month breakout. On the other hand, the move is pushing the price up to the area of the big round number at 0.7500 where we see a cluster of resistance levels. This suggests that the bullish move will probably run out of steam in this area, so there could be a short trade opportunity here later.

Scalpers might wait for an hour or so after London opens and then try to buy dips on bullish reversals on a short time frame chart. All traders might look for a short trade entry from a bounce off the key resistance level at 0.7505 which is very confluent with the round number.

There is nothing of high importance scheduled today concerning either the AUD or the USD.