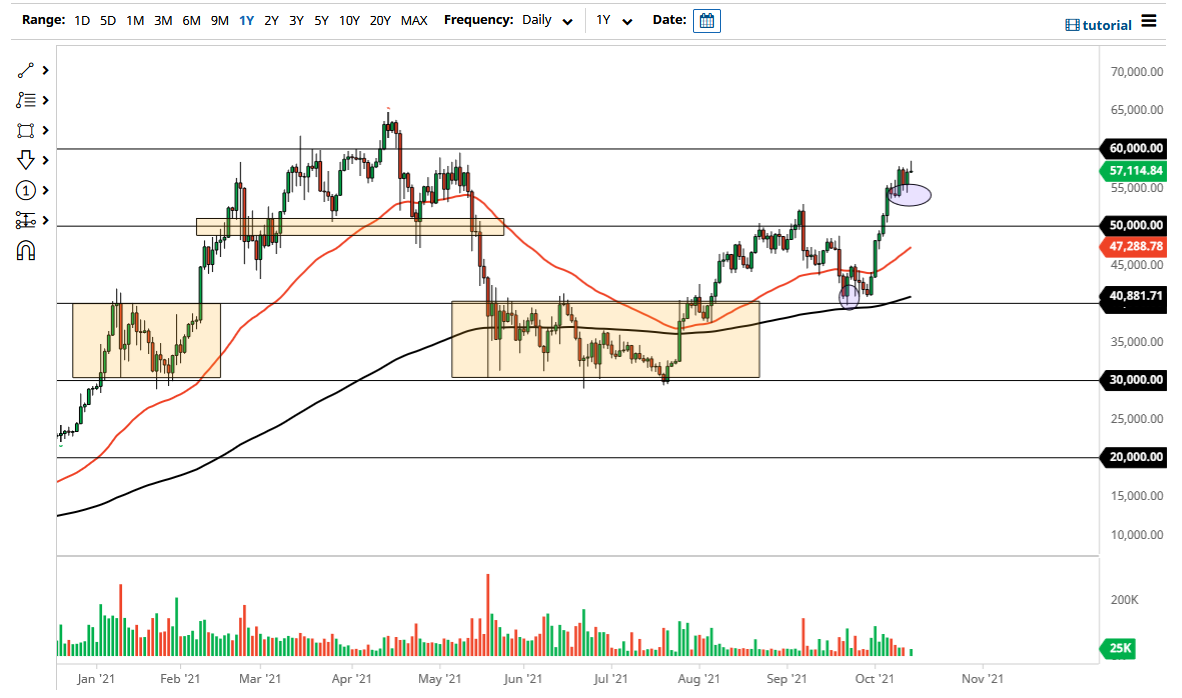

Bitcoin markets rallied initially during the session on Thursday but gave back gains in order to fall back into the previous consolidation area. The candlestick it is a shooting star, and that does suggest that we have a little bit more of a pullback just waiting to happen. That being said, I think the market probably continues to find plenty of support underneath, so pullback should be thought of as potential buying opportunities. After all, Bitcoin has been rallying quite nicely as of late, so I think at this point we need to see a little bit of digestion after the massive run higher.

I do believe at this point in time the $55,000 level will continue to be important, and we should pay close attention to it. This is an area that should be rather supportive, so as long as we can stay above there, I think in the short term we will have a “buy on the dips” type of short-term trading environment. However, if we were to break down below there then I think the market is likely to see the $50,000 level offer significant support also. The 50 day EMA is currently at the $47,289 level and rising, showing momentum is still in favor of the upside.

If we do break above the top of the shooting star from Thursday, then it is very likely we will go looking towards the $60,000 level rather quickly. The area just above there should continue to offer resistance extending up to the recent all-time highs and breaking above that of course will open up the door to even higher levels. Nonetheless, the momentum that we have seen in this market has been rather impressive, but nothing can last forever. If we get some type of pullback, I think there will be plenty of people willing to jump in and try to take advantage of “cheap Bitcoin.” In fact, it is not until we break down below the 50 day EMA that I even remotely struggle with the idea of the market going forward and doubt any type of pullback will be anything other than a momentum building exercise. Bitcoin has much further to go from everything I can see, although nothing goes in one direction forever, so pullback should be welcomed by even the most bullish of Bitcoin evangelists.