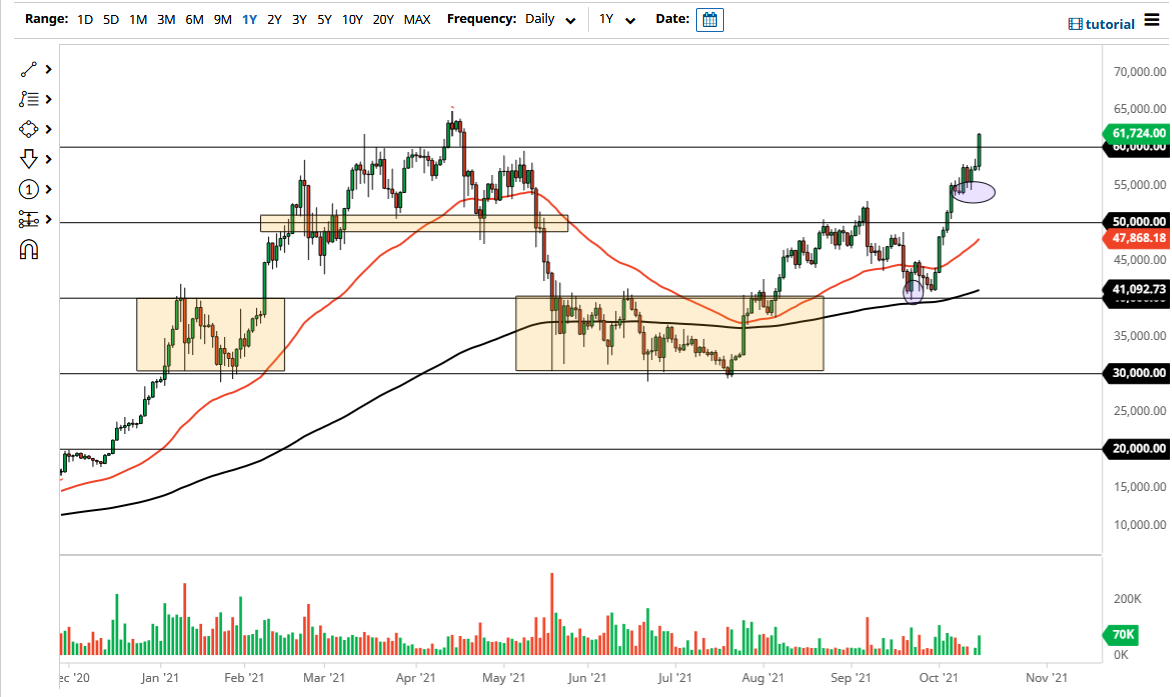

Bitcoin rallied rather significantly on Friday to break above the $60,000 level. By doing so, it shows that we are going to continue to see plenty of momentum, and that is not a huge surprise considering that rumors are swirling that the SEC is ready to approve a Bitcoin-based ETF. That will have more institutional money flowing into the market, so it should continue to add more volume.

With the $60,000 level now broken above, it is very likely that the market will go towards the all-time highs yet again. Whether or not it can break above there is an open question, but I certainly see no reason to think that it will not. The one major possible sticking point could be if the SEC does not garner regulatory approval for the ETF, which would almost certainly send this market crashing. That being said, there should be a significant amount of support underneath, especially near the $55,000 region, an area that we have recently been hanging about.

The trick about Bitcoin is that people tend to know things ahead of time. In hindsight, it is very obvious that somebody got word of this several weeks ago and has been pushing this market higher. The question now is whether or not there will be a massive dump once the news is released. That quite often is what happens, with people giving credence to the old notion “buy the rumor, sell the news.” This does not mean that we are likely to break down, just that we might get a bit of a pullback once that news is announced.

As far as a destination is concerned, Max Kaiser seems to think that we are going to $200,000 by the end of the year, but that is a bit absurd. After all, the man used to be a street magician, so I am not exactly sure what makes him somebody you should listen to. From a technical analysis standpoint, every time we pull back has been a buying opportunity bit it comes down to whether or not you are patient enough to realize the gains. The SEC allowing the ETF into the marketplace is a huge change, but you need to understand that some of the original reasons that people got into bitcoin are rapidly disappearing it will be a very interesting year next year as this market matures.