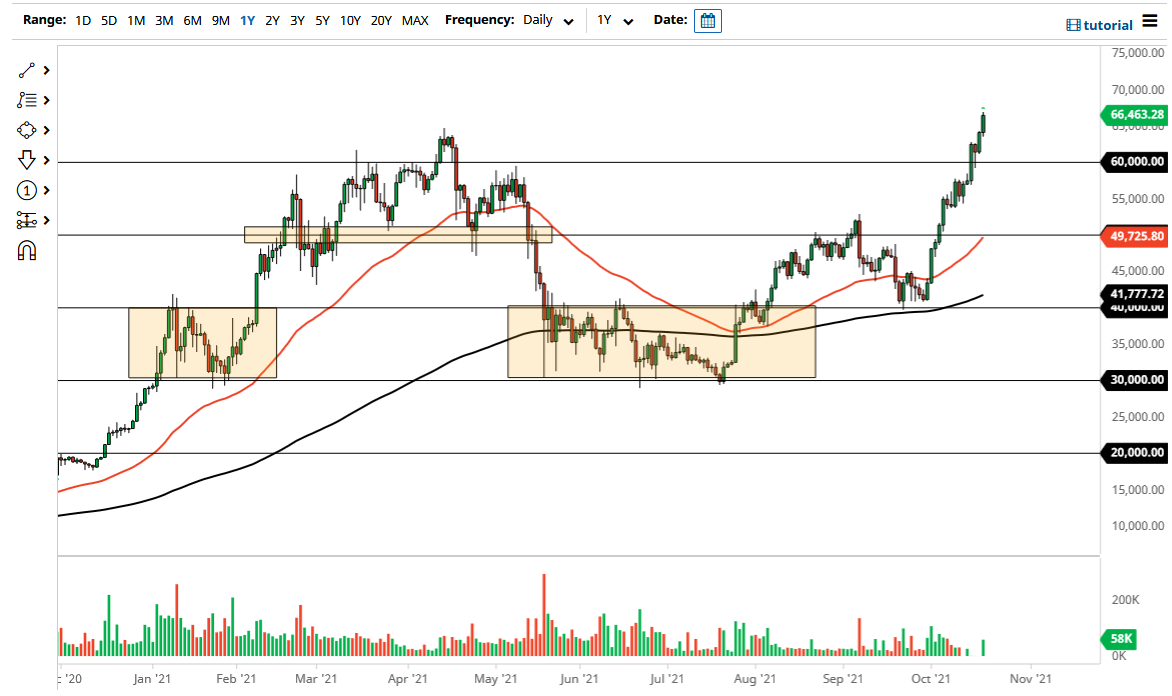

The Bitcoin market rallied significantly on Wednesday to reach above the $66,000 level. As we now have an ETF that has a lot of influence in the market, we will start to see Bitcoin more than likely act like the S&P 500, as it will become a passive investment for a lot of Main Street traders. Because of this, I think you probably only have a matter of time before this market takes off even further, but we are a bit parabolic. If you are going to get into this market, unless you are willing to hold onto a position, you probably need to see some type of pullback in order to trade.

As an investment, it obviously has a long way to go based upon what we are starting to see, so I think at this point the longer-term traders are simply buying and hanging on as part of their investment portfolio. That being said, I assume that most of you are looking to add to a position, so if we can pull back towards the $60,000 level, there will be a significant amount of buying pressure in that area. After that, we have the $55,000 level and then the $50,000 level. It is breaking below the $50,000 level that would make be concerned about Bitcoin, something that does not look very likely to happen in the short term.

I stated just yesterday that I was anticipating a potential move towards the $70,000 level, but at this rate it might be by the end of the week! Regardless, this is a market that you simply cannot short, at least not until we break down below the $50,000 level on a weekly close. The US dollar is also getting hit kind of hard, so that is helping this market as well, making Bitcoin look very attractive against the greenback, and most fiat currencies in general. The market currently sits at the all-time highs, and there is nothing at this point that is going to change the attitude of the market from what I can see. This general vicinity has nothing but “empty air” above it, so at this point one would just have to assume that the overall trend will continue forward.