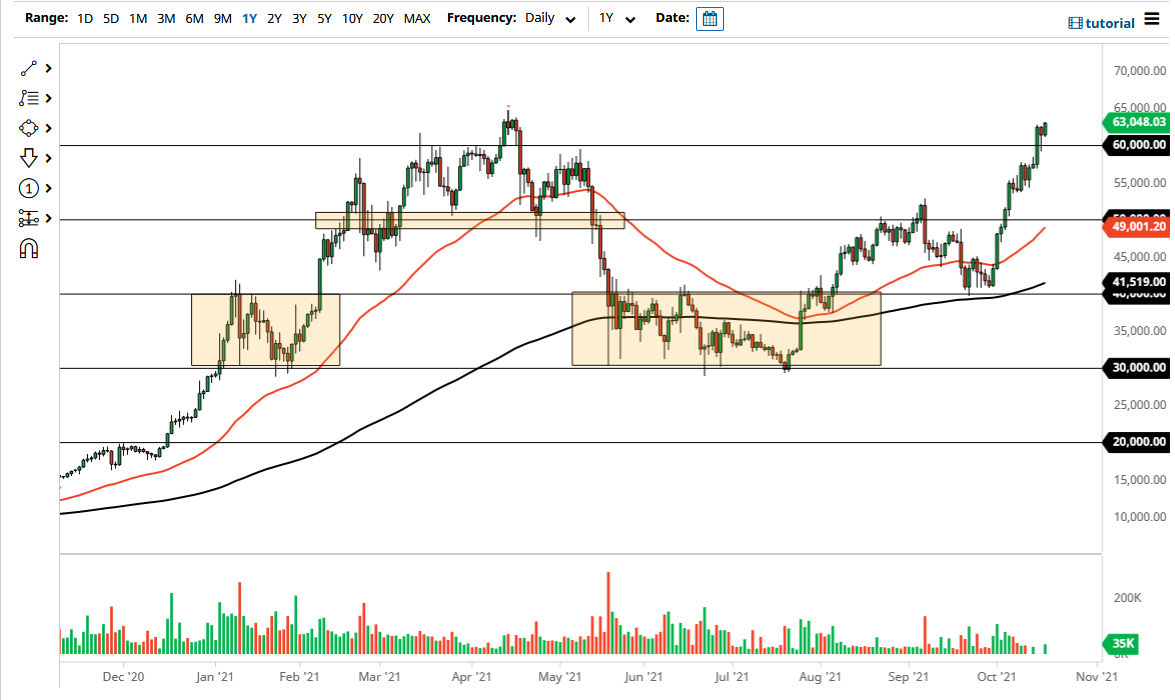

The Bitcoin market rallied again to break above the $63,000 level on Tuesday to show just how bullish the market is. The market is closing towards the top of the candlestick, and it is very likely that we would see more momentum come into this market. I think the next target is $65,000 and based upon the fact that we had formed a hammer during the previous session and then went higher, it is very likely that we will see a lot of further pressure to the upside.

Pullbacks at this point will look at the $60,000 level as a major support level, as it was a large, round, psychologically significant figure previously. The $60,000 level is an area that I think will continue to be very important, as it is not only a large, round, psychologically significant figure, but it is also an area that structurally had been important in the past. Keep in mind that with the Bitcoin ETF opening up this week, there should be a larger inflow of money coming into this market, so it is very likely that we just started a new leg higher. That does not necessarily mean that we will go straight up in the air, just that we have a lot of momentum underneath waiting to be released.

If we do break down below the $60,000 level, then I think the next major support area is going to be right around the $55,000 level, an area that we had consolidated at previously. Below there, we have the $50,000 level offering significant support and a potential “floor in the market”, as the 50-day EMA is starting to race there as well. This continues to be a “buy on the dips” market and, as a result, I will approach it as such. I would have no interest in shorting Bitcoin because that has been a losing bet for several weeks now, and if there is one thing we have learned about Bitcoin, it remains absolutely resilient regardless of what happens next. Longer term, I suspect that we are going towards the $70,000 level and beyond, so I do not have any interest whatsoever in trying to fight that action. As you can see, the market has been extraordinarily bullish, and you need to treat it as such.