Bitcoin markets pulled back just a bit on Tuesday to show hesitation, which is a good thing considering we have been so parabolic recently. This being the case, the $53,000 level underneath will more than likely offer a little bit of support, but even if we break down below there, I think that the $50,000 level will also have a major influence on where we go next, due to the fact that it is a large, round, psychologically significant figure and a lot of people will pay close attention to it.

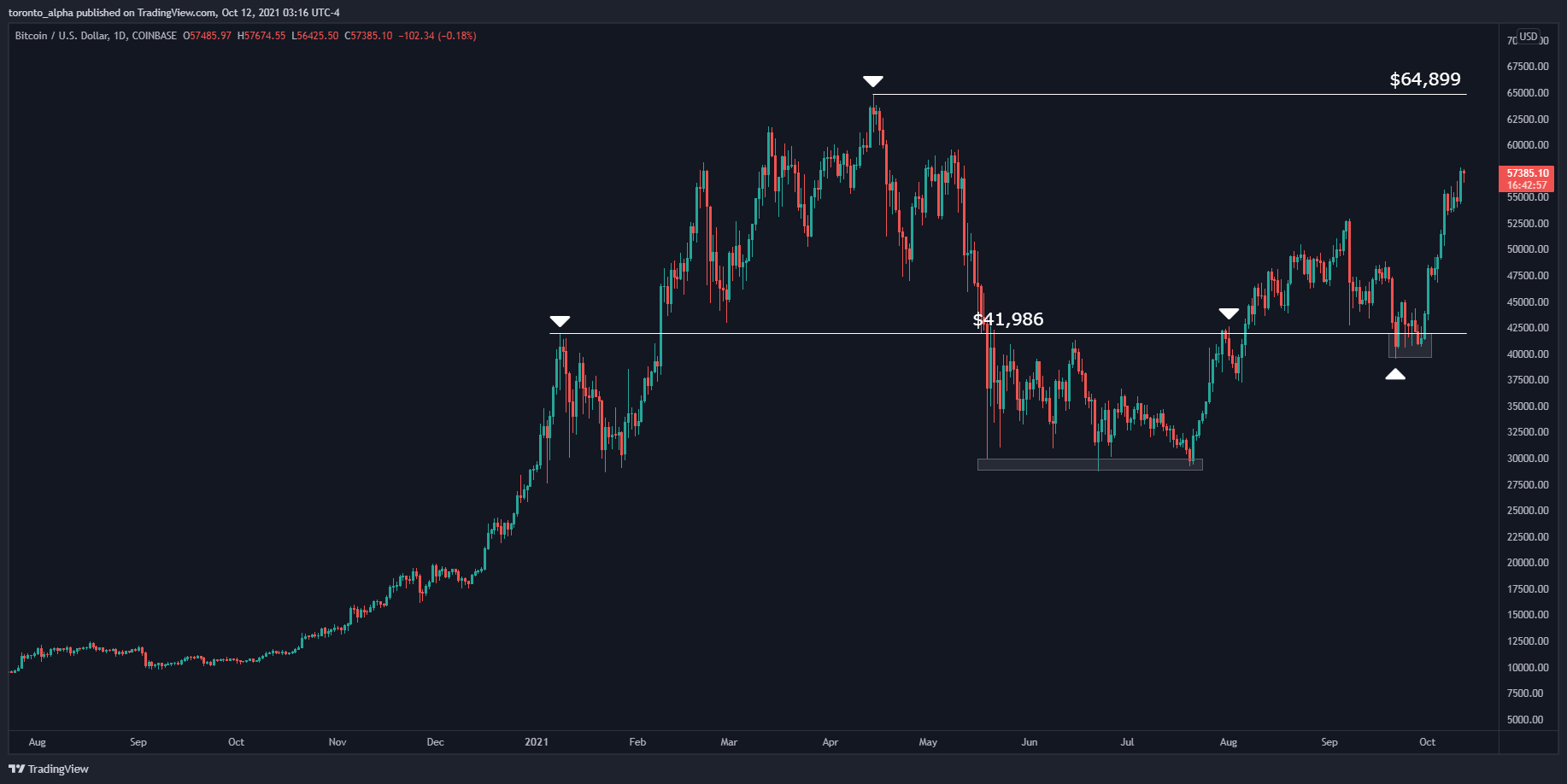

At this juncture, I do believe that the market is trying to get to the $60,000 level above, but that is an area that I think will be difficult to break. If and when we can, it will allow the market to go to the all-time highs, which I do think will eventually happen. Nonetheless, we have been a bit parabolic as of late, so I am cautious about getting overly aggressive in one direction or the other. Because of this, I think that you need to take time to build up a position and allow the market to tell you that it is going to go higher or lower before adding to the initial trade.

If we were to break down below the $50,000 level, then I think it is likely that we will go looking towards the 50-day EMA underneath, which is currently at the $46,500 region. It is sloping higher, and it does suggest that perhaps we are going to continue to see buyers on the dips that continue to drive the overall attitude of this market, as Bitcoin continues to attract a lot of attention and inflow due to so many different unstable markets. The parabolic move shows just how bullish we are, but to simply “chase the trade” is a great way to lose money, so I think you should continue to look for value on dips that show signs of stability or a bit of a bounce. You cannot be a seller of this market anytime soon, because we would need to see this market break down below the 50-day EMA to make that happen.