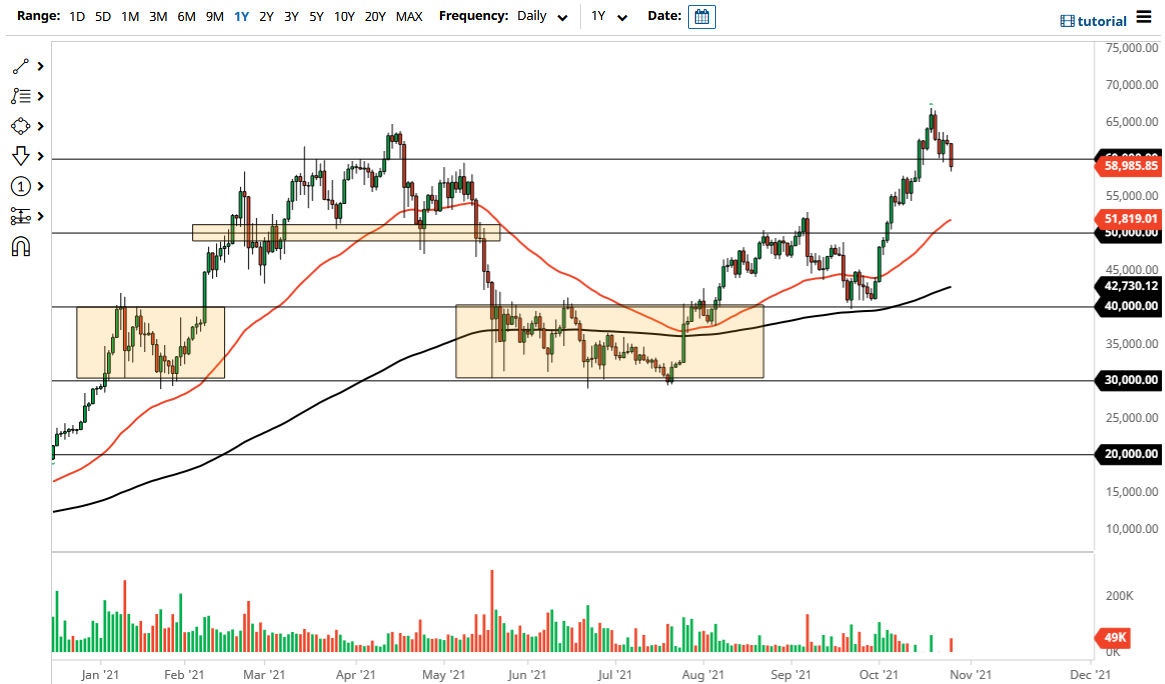

Bitcoin pulled back on Wednesday to slice through the $60,000 level. That being said, the market is still very bullish, and I think it is only a matter of time before we see traders come back into the market and get involved in what has been a very bullish uptrend. We have gotten a little bit overdone, so a pullback makes sense. I have been suggesting that the $60,000 level could be supportive, but I also suggested that the $55,000 level might be an area of interest below there, as it is not only a consolidation area, but it is also an area where the 50-day EMA is reaching towards.

On the other hand, if we were to turn around and break back above the $62,000 level, the buyers would continue to push towards the $67,500 level. After that, the market is likely to go looking towards the $70,000 level as Bitcoin seems to be attracted to the markets looking at every $10,000 as a support or resistance level. I do think that we get there given enough time, but it might be a bit noisy in the short term. In fact, when I look at this chart, I could even make an argument for a little bit of a bullish pennant or bullish flag be informed, but that remains to be seen over the next couple of weeks.

Looking at this chart, it is a bit extended, so consolidation is exactly what the doctor ordered. I have no interest whatsoever in trying to short this market, as crypto continues to attract quite a bit of attention. At this point, it is likely that we will see a push higher yet again, but we may have a couple of quiet weeks ahead of us as we trying to digest those massive amount of gains. The market staying above $50,000 is all that I ask to consider this as being in an uptrend. Below $50,000, I have to start taking a look at the market through different prison. I do think that it is likely that we will continue to see plenty of value hunters out there in a market that has rewarded those who have been patient.