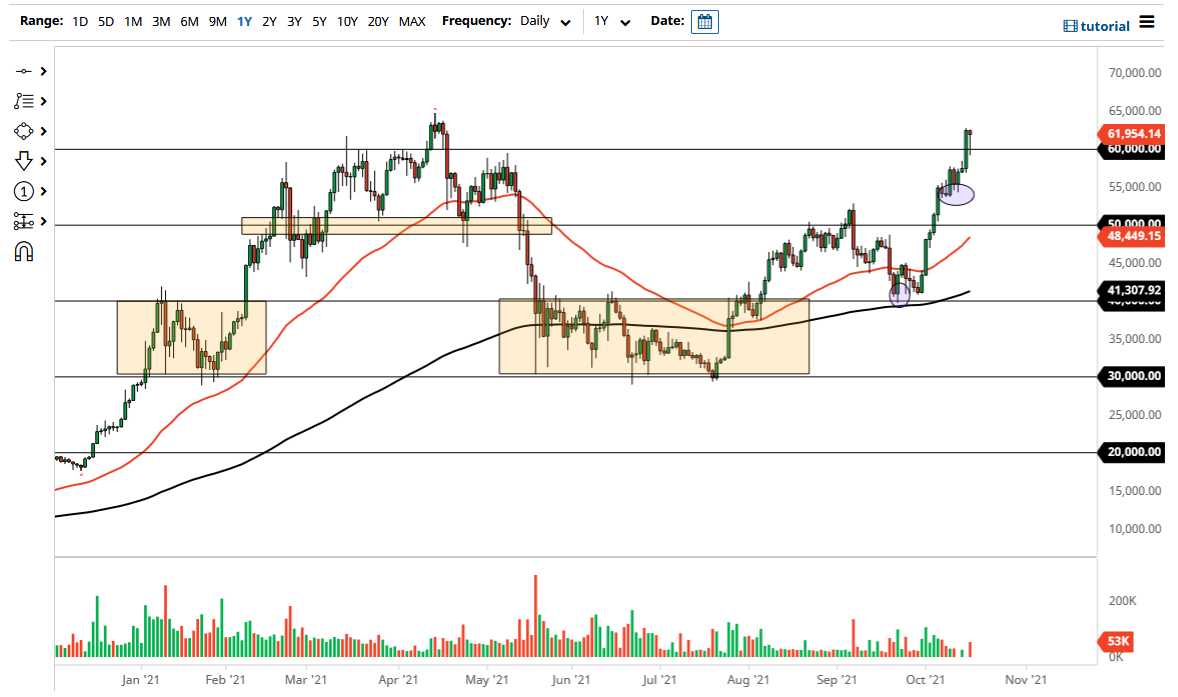

The Bitcoin market initially pulled back on Monday to sit just below the $60,000 level before turning around and showing life again. Because of this, it looks like the Bitcoin market is going to continue to climb, mainly driven by the idea of the new ETF that will be trading on Tuesday.

The shape of the candlestick certainly suggests that there is still plenty of momentum, and it is probably only a matter of time before we see the market jump back into bullish mode again and break out to a fresh, new high. In fact, it would not surprise me at all to see this market start to accelerate at this point. Pullbacks at this point in time continue to attract a certain amount of attention, especially underneath near the $55,000 level. That is an area that I would think that the bullish traders will be looking at as a potential value proposition, and then underneath there it is likely that the $50,000 level would be the absolute “floor in the market”, as it was a significant resistance barrier.

Looking at this chart, I have no interest whatsoever in trying to short Bitcoin, because it is like a runaway freight train, and with the new inflows coming into the market, that opens up the possibility of even further momentum chasing. This is a market that would have to break down below the 50-day EMA for me to consider even remotely shorting the market. The Bitcoin market is very strong for multiple reasons, not the least of which is the debasement of currencies around the world and of course the concerns about inflation.

We are a bit stretched at this point, but you should know by now that the crypto markets can shoot straight up in the air regardless. Pullbacks will continue to be buying opportunities, and I do believe that Bitcoin is going to probably go looking towards the $75,000 level over the next several months, if not weeks, if we get a little bit more in the way of input. The ETF should continue to increase demand, as more mainstream traders get involved into the market. Cryptocurrency continues to be one of the hottest asset classes, and Bitcoin is the leader.