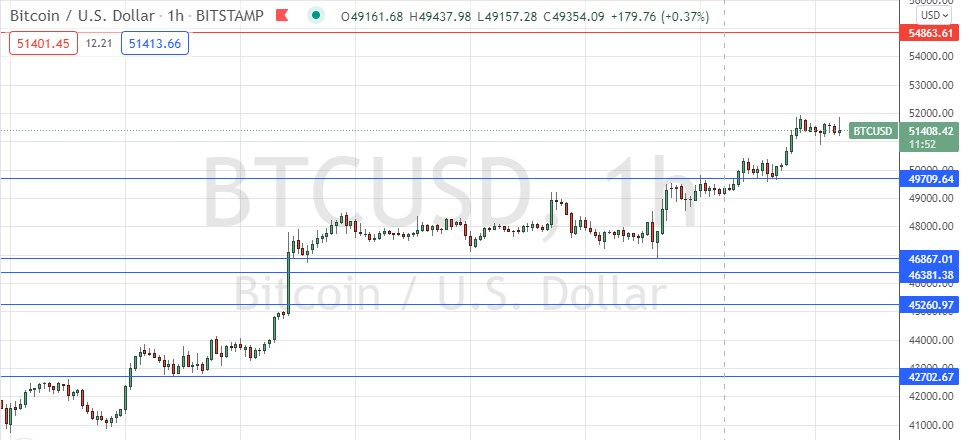

Last Monday’s BTC/USD signal produced a nicely profitable long trade from the bullish bounce off the support level identified at $46,867.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades may only be entered prior to 5pm Tokyo time Thursday.

Long Trade Ideas

Go long after a bullish price action reversal on the H1 time frame following the next touch of $49,710, $46,867, or $46,381.

Place the stop loss $100 below the local swing low.

Move the stop loss to break even once the trade is $100 in profit by price.

Take off 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to run.

Short Trade Idea

Go short after a bearish price action reversal on the H1 time frame following the next touch of $54,864.

Place the stop loss $100 above the local swing high.

Move the stop loss to break even once the trade is $100 in profit by price.

Take off 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote last Monday that the technical picture had become much more bullish, although the $50k might remain an obstacle to a further immediate rise in price. I saw the best opportunity likely to arise that day as a long trade from a bullish bounce at either $46,381 or $45,261. This was a good call as we got a nicely precise bounce from the higher of those two price levels.

The picture is even more bullish now as the price has continued to rise and trade above the big round number at $50k. There are now no obvious resistance levels holding back the price from a further advance to $54,864.

As always there has been a lot of hype around Bitcoin’s price rise this week, but it is nothing spectacular by Bitcoin’s usual standard. The price is close to only a 1-month high which shows bullish momentum, but this is not a major long-term development. However, it is significant that Bitcoin can trade quite bullishly while stock markets are falling as usually both are risk-on investments, so this is a bullish sign for Bitcoin.

As the short-term momentum looks healthy, I am ready to take a long trade today from a bullish bounce which might arise from a bearish retracement to the nearest support level at $49,710.

Regarding the USD, there will be a release of the ADP Non-Farm Employment forecast at 1:15pm London time, followed by crude oil Inventories at 3:30pm.