Bullish View

Set a buy limit at 65,000 and a take-profit at 70,000.

Add a stop-loss at 63,000.

Timeline: 3 days.

Bearish View

Set a sell-stop at 65,000 and a take-profit at 62,000.

Add a stop-loss at 68,000.

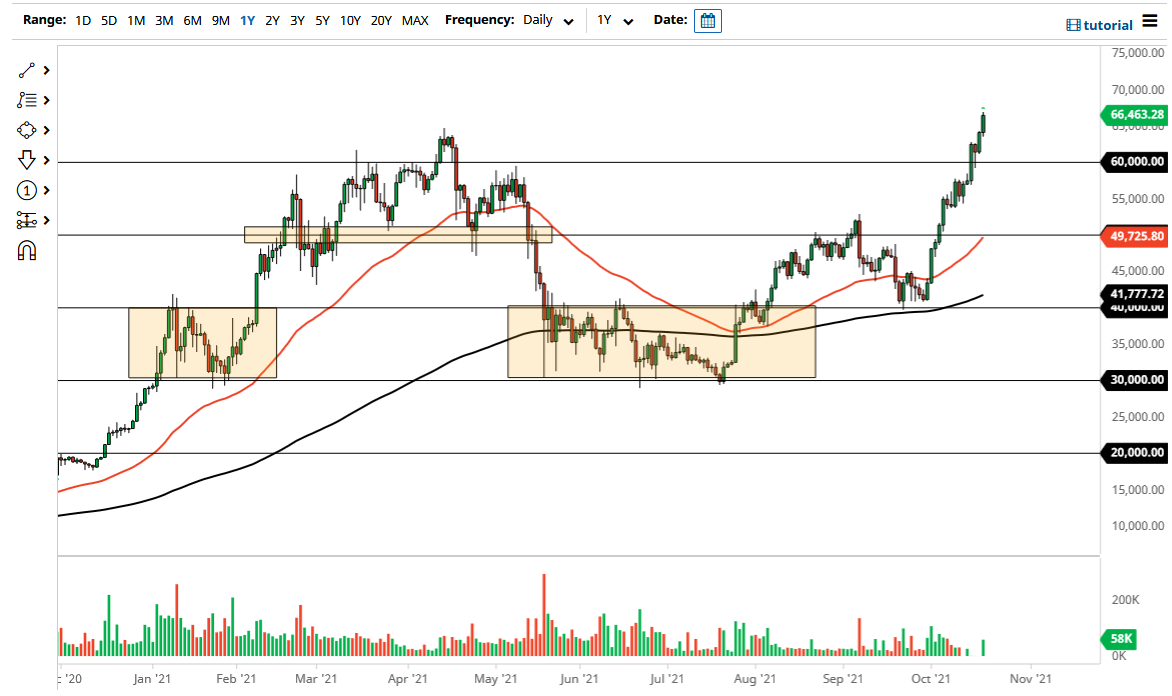

The BTC/USD pair maintained its bullish trend in the overnight session as investors cheered the rising inflows into the new futures ETF and the relatively weaker US dollar. Bitcoin rose to more than $66,000 for the first time ever.

Bitcoin Futures ETF

The main catalyst for the strong performance of the BTC/USD has been the launch of the first Bitcoin ETF product in the US. The fund, which has a ticker symbol of BITO, started trading on Tuesday and has seen significant inflows. Analysts believe that the fund will lead to more interest in the currency by institutional investors.

At the same time, the fact that BTC has managed to erase all losses that it made in the past few months will likely attract more investors into the asset. This is because many of them now believe that Bitcoin’s price will likely keep rising in the longer term. For example, Cathie Wood of Ark Invest believes that Bitcoin’s price will rise to $500,000 in the long term.

Other companies have also expressed interest in blockchain. For example, this week, Facebook unveiled a new cryptocurrencies wallet that will use Coinbase as a custodian. The NBA also partnered with Coinbase in a bid to launch a new NFT collection.

The BTC/USD also popped because of the overall weaker US dollar. The US Dollar Index, which tracks the currency against key peers, has fallen to the lowest level in more than three weeks. These losses increased when the US published weak building permits and housing starts data.

It also declined as investors placed bets that other central banks like the Bank of England (BOE) and the RBA will hike rates earlier than expected. Later today, the currency will react to the initial jobless claims data.

BTC/USD Forecast

The BTC/USD pair has been in a strong bullish trend. It has risen by more than 130% from the lowest level in July. And overnight, it managed to move above the previous all-time high of near $65,000. The bullish trend is being supported by the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has jumped substantially.

Therefore, while a pullback will likely happen, the path of the least resistance for the pair is to the upside. The next key resistance level to watch will be 70,000.