Bearish View

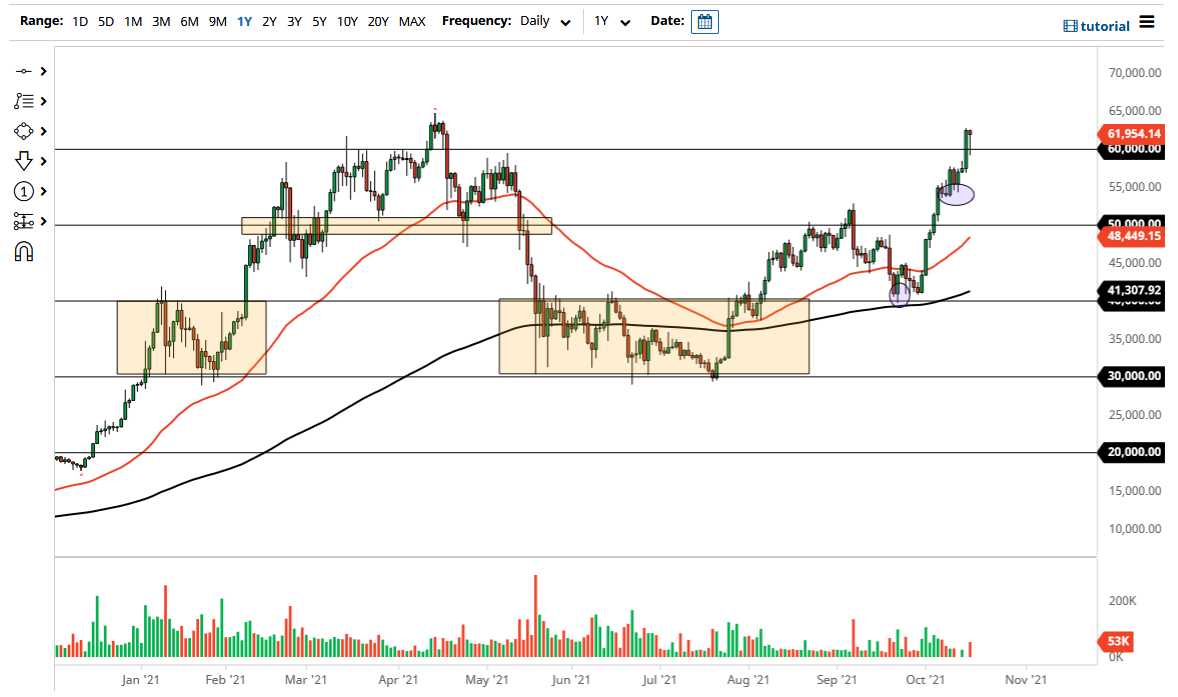

Set a sell-stop at 60,000 and a take-profit at 57,000 (lower side of ascending channel)

Add a stop-loss at 63,000.

Timeline: 1-2 days.

Bullish View

Set a buy-stop at 62,500 and a take-profit at 63,500.

Add a stop-loss at 61,000.

The BTC/USD price held steady as investors reacted to news that the Securities and Exchange Commission (SEC) had given a go-ahead to the first Bitcoin ETF. It also rose as inflation fears continued spreading in the US. It remained above the important resistance at $62,000.

Bitcoin ETF

ProShares, a company that provides hundreds of ETFs, became the first firm to list a Bitcoin futures ETF on Monday. The company managed to get authorization from the SEC and analysts expect that more similar funds will be coming. Already, companies like Ark Invest and Invesco have applied for their own funds.

Analysts expect that these new funds will make Bitcoin more mainstream among institutional investors who are afraid of investing in Bitcoin directly. Also, the funds will be relatively cheaper than the alternative of investing in the Grayscale Bitcoin Trust.

Still, there are concerns about the long-term impacts of the Bitcoin ETF. Besides, institutional investors have had access to a Bitcoin ETF listed in Canada for years. Also, people interested in Bitcoin will opt to buy the real currency rather than go through an ETF.

Meanwhile, on-chain data shows that there are signs that activity in the Bitcoin market is improving. For example, leverage in the derivatives market has grown while there is a substantial growth in options volume and open interest. The most preferred strike price for most bulls has been at $100k. Hash rates have also risen in the past few weeks.

However, data also shows that many long-term holders have started exiting their positions. Historically, these holders tend to love buying the dips and selling when the price is at a major high.

The BTC/USD has also risen as more investors price in higher inflation as supply issues rise. As such, some investors believe that Bitcoin is a good hedge of inflation.

BTC/USD Technical Analysis

The BTC/USD pair was little changed as the market reflected on the ETF issue. The pair is trading at 62,000, which is slightly below the weekend high of more than 62,500. The price has moved above the 25-day and 50-day moving averages. It is also slightly below the upper side of the ascending channel shown in blue.

Therefore, while the long-term view of Bitcoin is bullish, a short-term reversal cannot be ruled out. This action could happen as participants sell the ETF news.