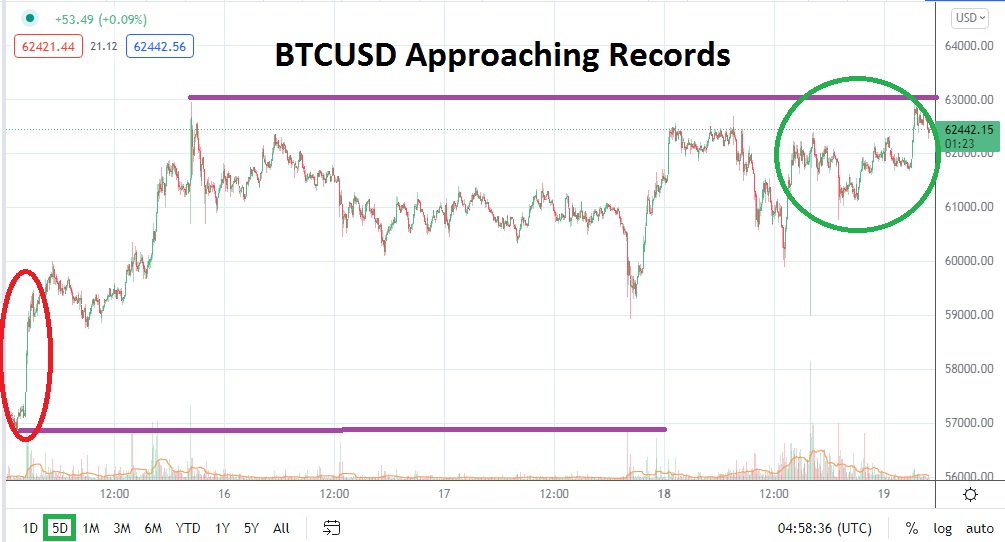

Experienced traders of BTC/USD are likely to be an excited group of individuals today. Bitcoin is moving fast and is producing volatility as it trades within sight of record highs. Traders looking to gain a perspective on the potential direction of BTC/USD need to look at one year charts. BTC/USD is certainly within sight of record values achieved in mid-April of this year. Hovering slightly below the 63000.00 mark, BTC/USD is moving in large increments and traders are urged to enter the market with entry price orders so they do not get killed on fills which do not meet their expectations.

As of this writing, BTC/USD is trading near the 62500.00 mark, but its movements are lightning quick and speculators are urged to monitor Bitcoin and not trade blindly. A high of nearly 63000.00 was almost touched yesterday, which surpassed values traded on the 15th of October. Yes, BTC/USD was trading at nearly 29000.00 on the 20th of July. This is underscored to show that BTC/USD has doubled its price in three months and to emphasize the amount of volatility Bitcoin can produce. What can go up can go down, and obviously what can go down can reverse upwards again in cryptocurrencies.

BTC/USD is certain to be on the lips of many financial media outlets today as the record prices are spoken about and people wonder if a new record high is about to occur. The question is if this will generate more speculative zeal, or if a sudden selloff could occur. What traders should ask is if they want to be the one to try and stand in the way of the exuberant trend upwards which has been generated the past three months? The bullish movement has been strong and if record prices are challenged it could be sooner rather than later.

BTC/USD traded near a high of 65000.00 for a brief moment in the middle of April. If BTC/USD is able to break the 63000.00 mark near term and sustain a price over this level, it is quite possible Bitcoin will continue to rise and may see a tide of buying which aims for the record level. Current support can be said to be around 62300.00 for BTC/USD, but traders need to understand that Bitcoin can move in increments of one hundred USD in the blink of an eye. Wagering on upside momentum in BTC/USD appears to be the logical and potentially worthwhile speculative bet.

Bitcoin Short-Term Outlook

Current Resistance: 62850.00

Current Support: 62025.00

High Target: 63200.00

Low Target: 61841.00