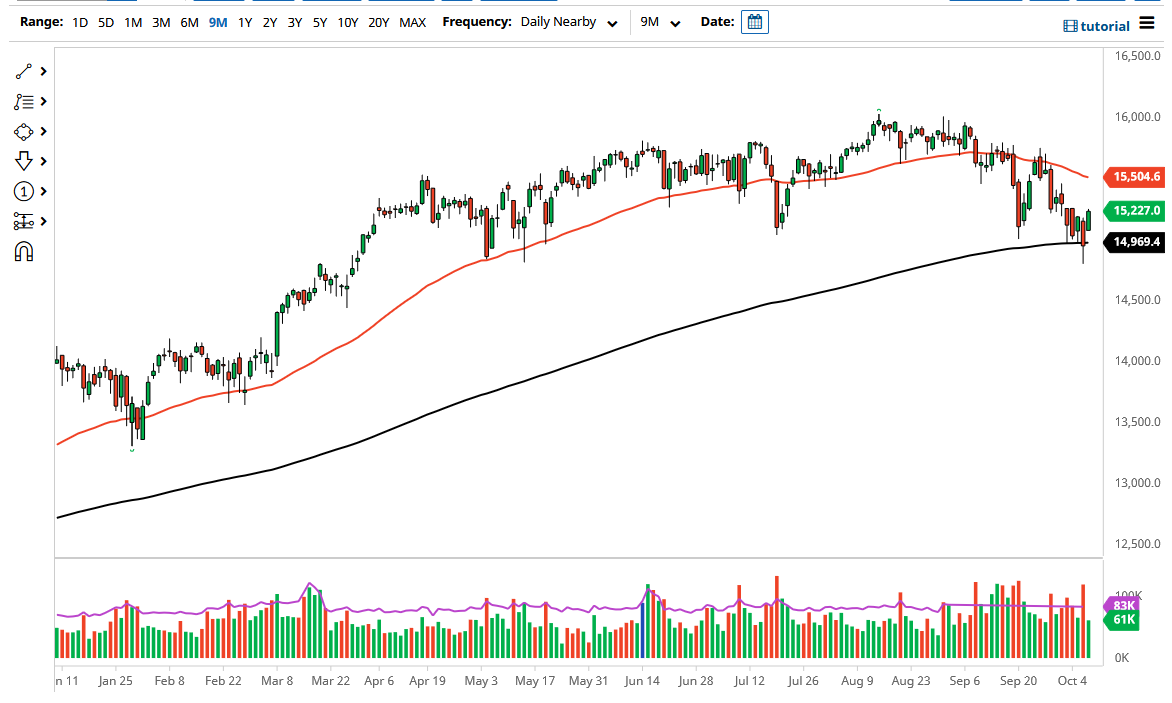

The German index has rallied significantly during the course of the trading session on Thursday to reach towards the 15,250 level. The market breaking above that level then opens up the possibility of a recovery to go looking towards the 50 day EMA. The 50 day EMA of course is sloping lower and is an indicator that a lot of people would pay close attention to that. All things been equal, this is a market that looks very likely to continue going higher but will also have to deal with a lot of momentum.

To the downside, the 200 day EMA continues to see a lot of interest, which is basically where we had bounced from. That being the case, it is very likely that we could continue to see plenty of buyers, but at this point in time if we were to go higher it is likely that the 15,500 level could cause a little bit of resistance, and then perhaps open up the possibility of a move towards the 15,750 level.

The German index is highly driven by industrial demand around the world, as there are a lot of the major players in this index are industrial corporations. In other words, we need the reopening trade to continue to strengthen in order for the DAX to do the same. The market certainly has had a nice correction, and stock markets around the world are all starting to show signs of perking up again. The jobs number on Friday in the United States could give us a little bit of a “heads up” as to what the Federal Reserve will do, and that of course has a major influence on interest rates around the world with other central banks.

The market has been very choppy as of late and I anticipate that is exactly what we are going to see going forward. If we were to break down below the bottom of the candlestick from the Thursday session, that could open up quite a bit of selling, perhaps reaching down towards the 14,500 level, possibly even the 14,000 level after that. That is not my base case scenario, but it is something that I see as a potential move. The market continues to be noisy, but in the long term I do think that we eventually get back towards the highs.