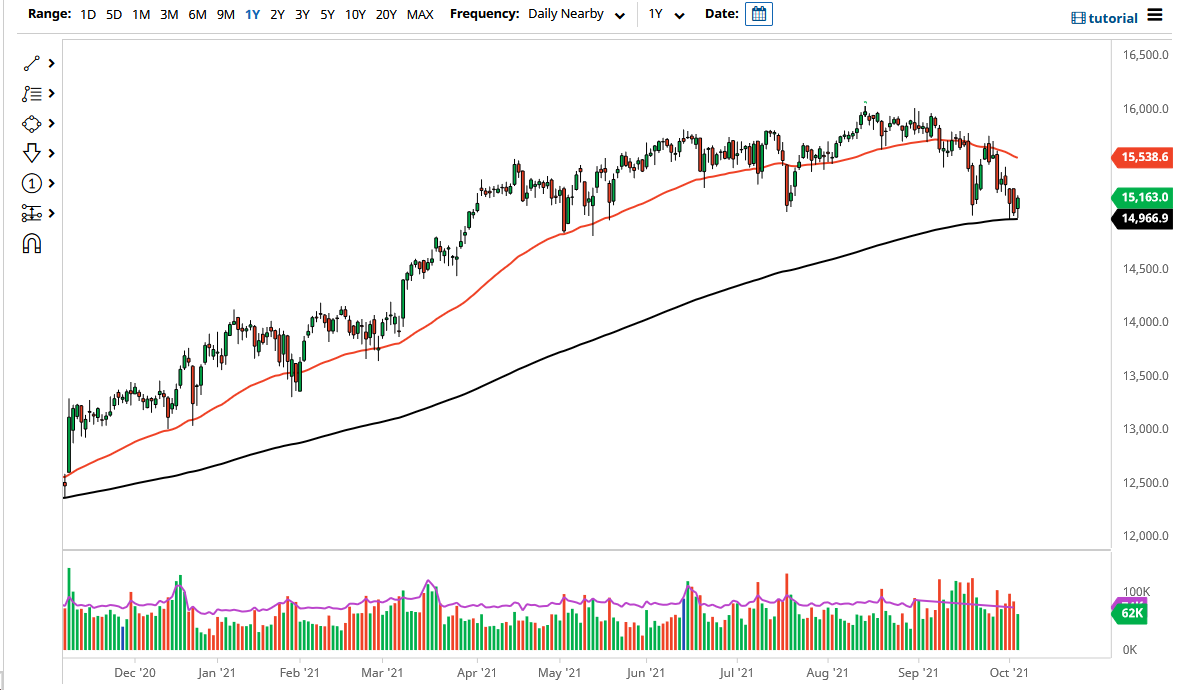

The DAX Index fell initially on Tuesday but found enough support at the 200-day EMA to show signs of life again. By doing so, it looks as if the DAX is going to try to save itself, and the fact that the 200-day EMA sits just below the 15,000 level makes sense as well. With that being the case, the market is likely to continue to see support in that general vicinity. The market quite often will pay close attention to this indicator, so it is not a huge surprise to see that a certain amount of value hunting has happened.

Looking forward, if we can take out the highs of both the Friday and Monday candlesticks, then it would be a very good look in general. In other words, if we can get above the 15,250 level, then it is likely that we will try to recapture the overall uptrend. However, if we break down below the lows of the last couple of sessions, meaning that we clear the 200-day EMA on a daily close, that could open up a move down to the 14,500 level, maybe even as low as the 14,000 level.

Central banks around the world protect their own stock indices, so it is probably only a matter of time before the ECB does some type of quantitative easing scheme in order to lift the markets again. That being said, there are a lot of concerns right now, not the least of which would be the Chinese debt situation that a lot of people are worried about becoming contagion. Beyond that, you also have a spike in coronavirus infections in various parts of the world, through the Delta variant.

Keep in mind that the DAX is highly sensitive to exports coming out of Germany, as some of the biggest companies on this index are major industrial exporters. As the world reawakens, there are multiple companies in Germany that will be at the forefront of providing the heavy equipment necessary to do so. With that, this is more or less going to continue to be a “global reopening trade” than anything else. It is also the first place that money goes looking to work in the European Union as far as indices are concerned.