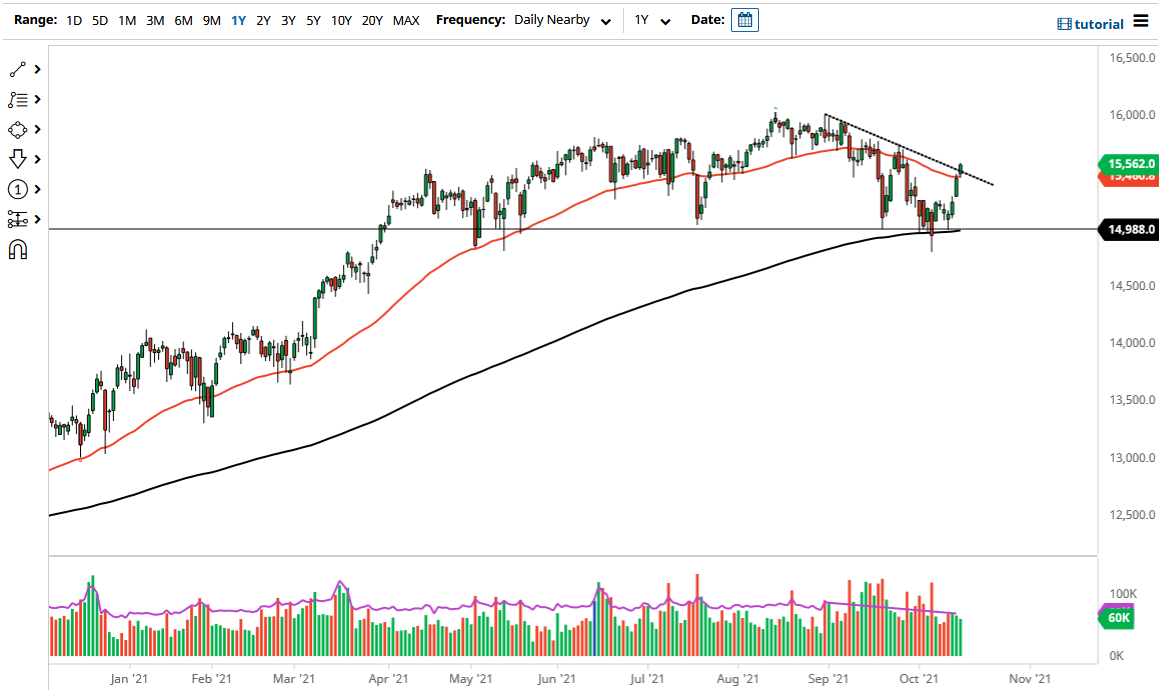

The DAX Index rallied on Friday to break above the 50-day EMA solidly, and more importantly to break above a major downtrend line. Because of this, the DAX looks as if it is ready to go higher over the longer term, and I think that with any type of pullback we are likely to see people jumping in to pick up bits and pieces of value. The market will continue to see reasons to go higher, based upon the fact that stock markets overall have been rallying. It has seen quite a bit of momentum jump back into the upside, so a lot of people will continue to look at it through that prism.

The €15,000 level has been very supportive, as we bounced from there yet again on Tuesday. Forming a couple of hammers right around that region and the fact that the 200-day EMA is sitting right there suggest that there is going to be a lot of bullish pressure and buying. Now that we have made a parabolic move since then, I think it makes sense that the DAX will continue to go higher.

Any pullback at this point I think offers a nice opportunity, as the turnaround has been rather violent. If we break above the top of the candlestick for the trading session on Friday, that only shows that we have more continuation to the upside, and I think it is likely that we would go higher at that point. Then I would anticipate that €16,000 would be all but assured, and just as we have seen multiple times, the market is ready to go higher at the slightest hint.

Looking at this chart, I think it is only a matter of time before we continue to see reasons for the DAX to go higher, as the European Union seems to be trying to recover. Furthermore, we see the euro falling significantly, and that gives the idea of exports rising a bit of prudence. That being said, the market is likely to see a lot of noisy behavior, but it certainly looks as if all stock markets are starting to rally, and the DAX is simply following suit.