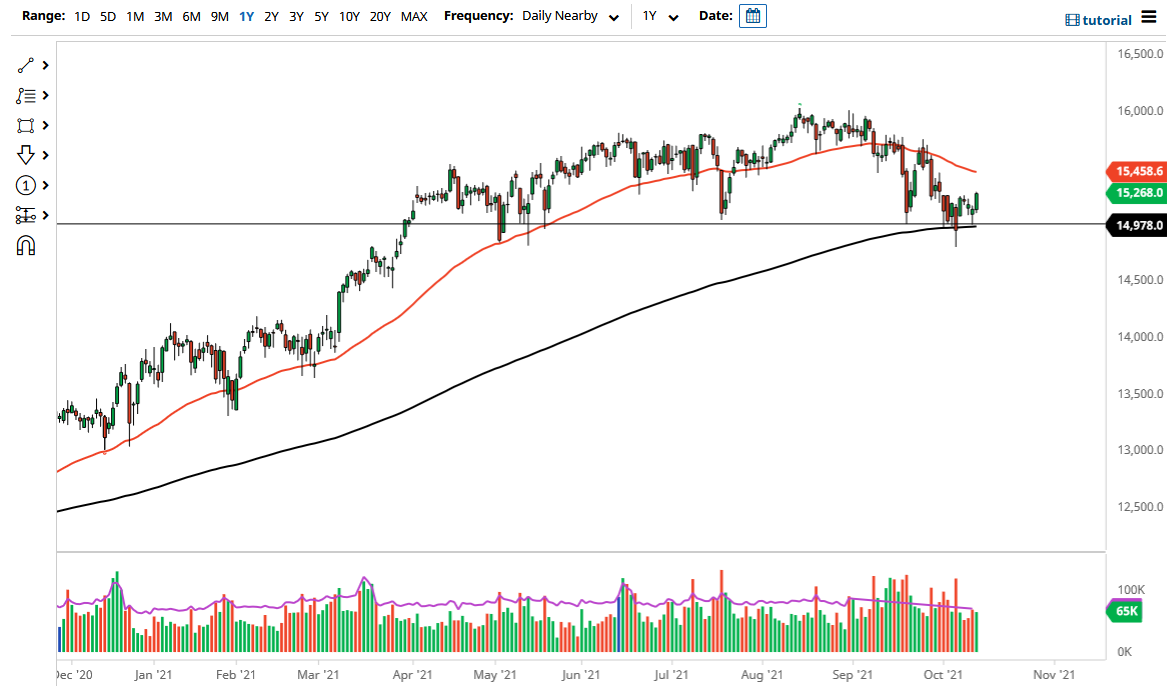

The DAX rallied on Wednesday to show signs of life again. In fact, we have broken through a lot of noise that the market had been struggling with over the last couple weeks, so this is a very bullish sign. The 200-day EMA has shown itself to be important and reliable, and it looks as if we are going to continue to see more upward momentum than anything else. The 50-day EMA is currently sitting at the 15,450 level and suggests that we are going to continue to see an attempt to get towards that area at the very least.

Germany is one of the first places where money goes to work in the European Union, so it is probably going to be the first place where you start to see a lot of bullish pressure. The fact that we closed towards the top of the candlestick does suggest that there is going to be a little bit of follow-through, so I do like the idea of trying to get long of this market. Whether or not we take off during the session on Thursday is a completely different question, but I would anticipate that there will at least be an attempt made to get positive. If we can continue to reach higher, I think it is probably only a matter of time before we reach the all-time highs yet again. After all, the market is likely to continue looking through the prism of whether or not the reopening trade continues, and right now it is likely that we will see traders banking on the idea of more economic output.

Germany is a huge industrial powerhouse and puts out a lot of industrial goods, so you need to see the DAX through the prism of supplying the rest of the industrial world machinery and the like. If we are going to reopen, then a lot of those goods that are necessary will continue to be in demand. These industrial conglomerates make up the bulk of the DAX, so it all ties in together with the global reopening situation. I have no interest in shorting this market, unless we break down below the 14,800 level underneath, from where we had turned around.