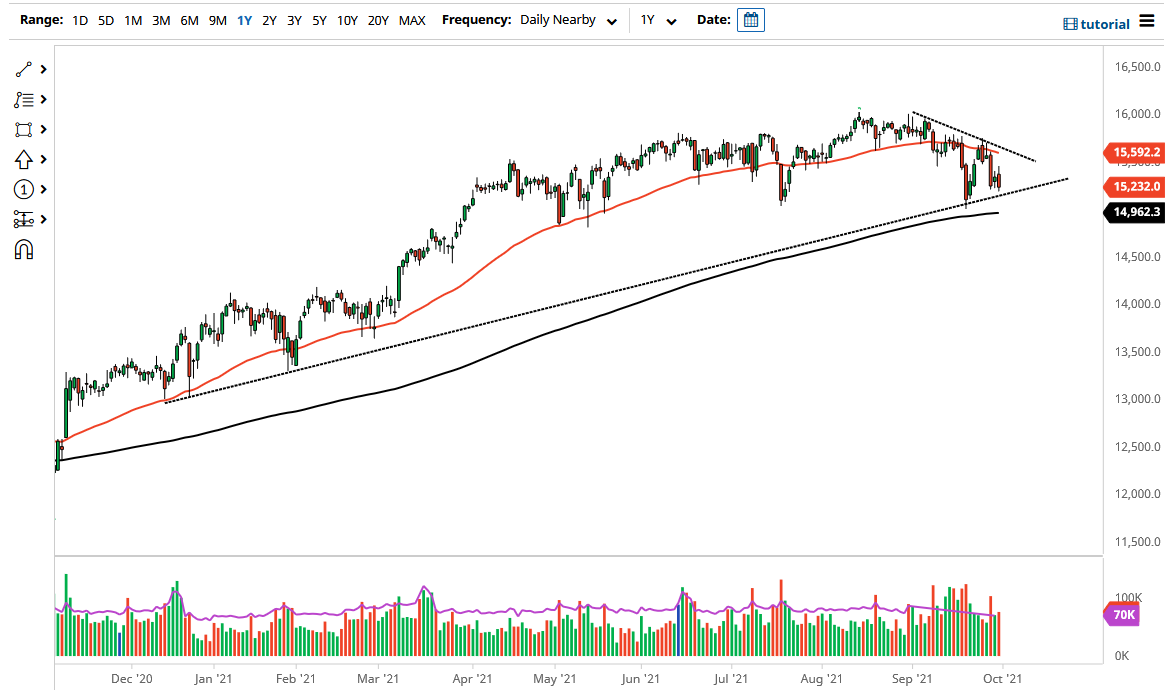

The German index has gone back and forth during the course of the trading session on Thursday as we continue to test the major trendline underneath. The uptrend line of course is a rather reliable one going back quite some time, so it does make a certain amount of sense that we see a bit of a fight here. That being said, if we can break down below the lows of last week, then the DAX is going to be free to challenge the 200 day EMA, which in and of itself attracts a certain amount of attention.

Breaking down below the 200 day EMA is likely to be very negative, thereby opening up fresh selling pressure. Obviously, the DAX is very much like other indices around the world where we need to see a certain amount of risk appetite in order for it to go higher. The market is going to continue to be very noisy, especially as we are stuck between the 50 day EMA above and the 200 day EMA underneath. In other words, there is no clear determining trend other than we are grinding sideways over the last couple of weeks. I think a lot of this comes down to the risk appetite of traders around the world, and of course whether or not the markets are going to enjoy a strengthening global economy. Right now, it does not look likely that we are going to, at least not right away.

At this point, if we can break above the 50 day EMA, then I might become quite a bit more positive in this market, and I think we would probably go looking towards the €16,000 level. On the other, if we break down below that 200 day EMA, it would not surprise me that much to see this market go looking towards the €14,000 level underneath. Either way, I think in the short term we are simply going to grind back and forth in what is a little bit of a triangle that has been formed. I believe at this point in time we need to see this market make a fairly impulsive candlestick that we can take advantage of, as it would show inertia breaking in one direction or the other. With that, patience will probably be the most important thing.