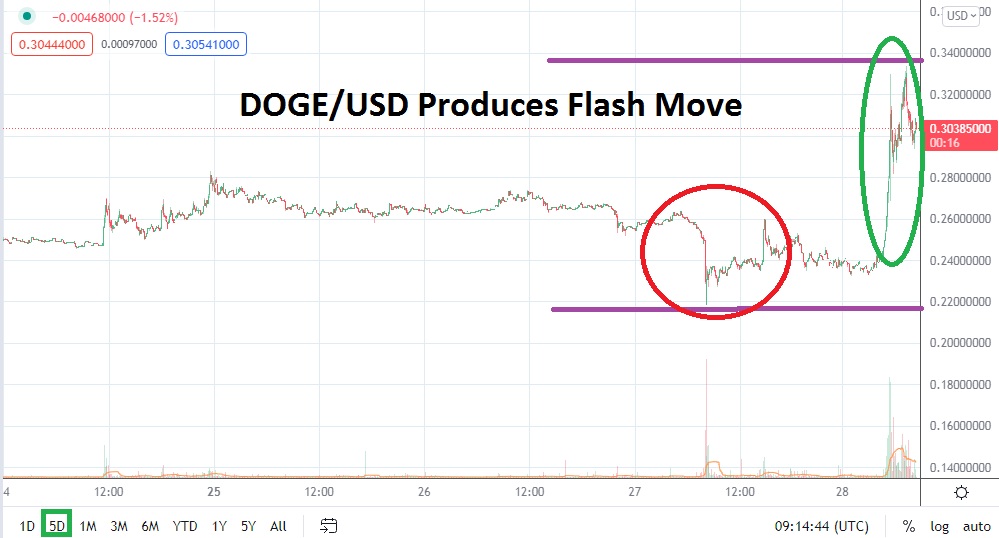

DOGE/USD advanced abruptly in early trading this morning as it went from roughly 23-and-a-half cents to almost 33 cents in the blink of an eye. The surge of buying which clearly erupted this morning has caused a change of perspective via technical charts and likely in the mind of some analysts.

The notion that Dogecoin had been lingering near important lows as trading began this morning would have been a logical first impression. The second thought which may have been considered was that perhaps DOGE/USD had started to lose some of its speculative luster as counterparts like Shiba Inu and SafeMoon garner greater attention.

The recent turnaround in Dogecoin was fast and the bullish momentum should get attention, but what if traders are about to be sucked into a void when they attempt to buy and find DOGE/USD suddenly reverses lower. This thought has been written before about DOGE/USD but remains an always present danger.

In the blink of an eye today DOGE/USD surged higher and nearly hit the 33 cents level. The fast movement for DOGE/USD is unlikely to be finished today and traders should be prepared to read the written values in this article and then look at market conditions to see if they match later. Currently the price of DOGE/USD is near 29 cents and conditions remain rather volatile. Speculators who want to be buyers may want to consider the possibility that today’s earlier move was some form of ‘organized’ action by traders participating in social media groups.

DOGE/USD has been within a lackluster range the past month of trading compared to many of its major counterparts, important low ratios were certainly being contested even as other cryptocurrencies have recently touched highs. Today’s jolt of lightning within DOGE/USD is a reminder that Dogecoin remains an important part of the speculative landscape.

The question that will prove to be interesting in the near term is if this morning’ bolt upwards is going to prove short lived. If that is the case, making a speculative wager to sell DOGE/USD near current resistance levels, or perhaps even selling when support levels prove vulnerable could be an intriguing bet while looking for more downside price action.

Dogecoin Short-Term Outlook

Current Resistance: 0.31950000

Current Support: 0.28520000

High Target: 0.336700000

Low Target: 0.23050000