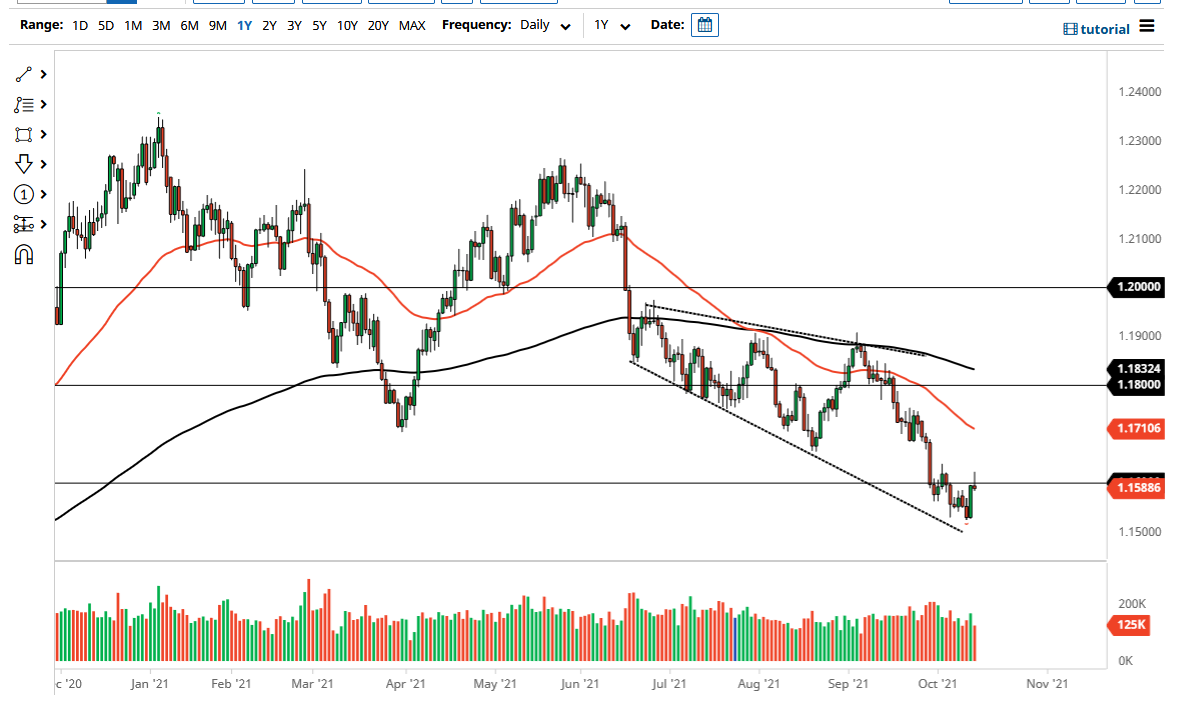

The Euro initially rallied to break above the 1.16 level before turning around and showing signs of hesitation. By doing so, we ended up forming a bit of a shooting star, which of course is a negative turn of events. Furthermore, the 1.16 level was an area that I anticipated being resistance between here and the 1.1650 level, so pulling back from there does show that perhaps the downward pressure continues. After all, the market continues to be very anti-Euro, and I think that may continue to be the case as the European Union has a lot of issues are now.

The EU has trouble powering itself, so it should be noted that the economy is clearly going to struggle in that type of situation. With this being the case, I think that it makes sense that the Euro will underperform so many of the other currencies, even the US dollar which has been getting hammered. That being said, I think it is probably only a matter of time before we see an attempt to get below the 1.15 handle, which of course is a major level on longer-term charts. The market will continue to see this as an area that will probably be heavily defended but breaking down below there then would open up the market to move down towards the 1.1250 level.

Just above, I think the resistance extends to the 1.1650 level, as we have seen a lot of noise up to that level. If we break above there, then the market is likely to go looking towards the 1.17 level that extends to the 1.1750 level. It is not until we get above there that I would consider the market is one that I could buy. The market will continue to see a lot of noisy behavior more than anything else, but it certainly looks as if the sellers have stepped in and kept the buyer from taking over in what could have been a very big move. Obviously, we will have to see how the market plays out before we put a ton of money into it, but on a breakdown below the bottom of the candlestick for the session on Thursday I am willing to start shorting again. If we break down below the 1.15 level, then I will get aggressively short yet again.