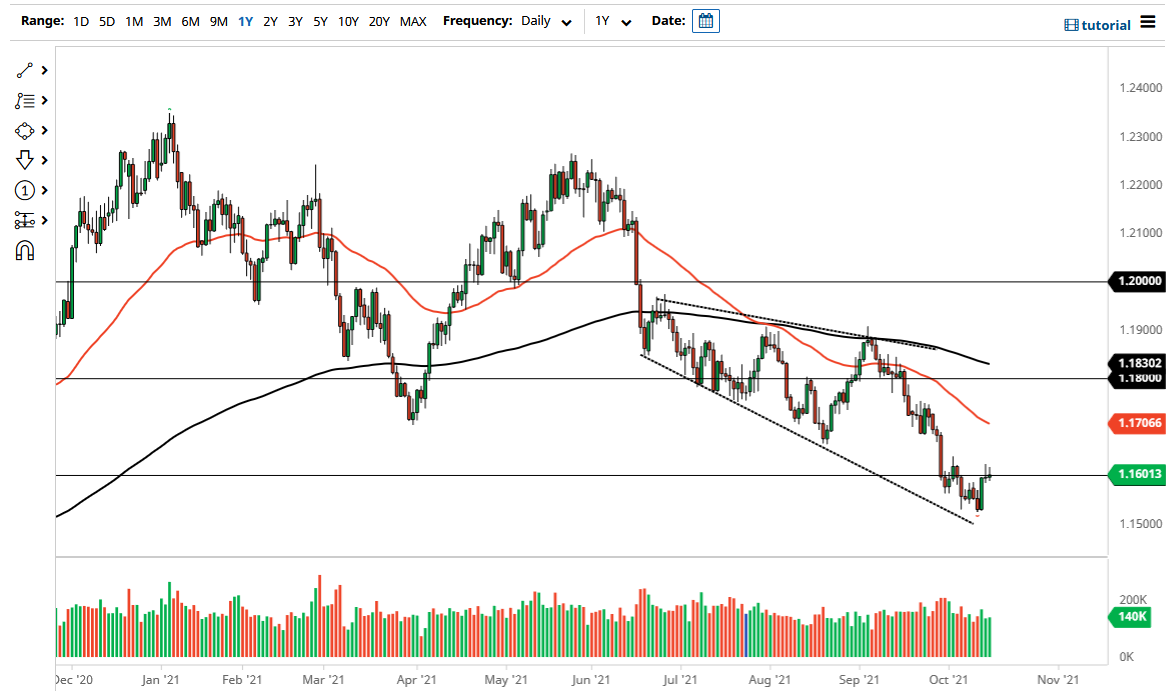

The euro rallied significantly on Friday but gave back the gains to turn around and form a shooting star again. The 1.16 level has been an area that has been important multiple times, and the fact that we pulled back from there on Friday just as we did on Thursday tells me there is a lot of trouble just waiting to happen. Furthermore, the 1.16 level begins resistance that extends to the 1.1650 level after that.

If we break above that level, then the market is likely to go looking towards the 1.1750 level. The 50-day EMA is sitting in that general vicinity, and it is likely that we will continue to see a lot of downward pressure even in that area. What is interesting is that the US dollar has fallen against multiple currencies, but the euro is an outlier. This shows just how weak the euro is, so I would not be a buyer of it against any currency, despite the fact that there are a few bullish markets like the EUR/JPY pair.

If we break down below the lows of the last couple of candlesticks, it could open up a move down to the 1.1550 level, perhaps even down to the 1.15 level after that. If we were to break down below the 1.15 level, that could open up a significant selloff from that area in this market to go down towards the 1.1250 level over the longer term. Remember, this pair does tend to be very choppy and more of a grind than anything else, but occasionally we will get the “trapdoor opening”, because there will be a sudden move. I think that if we break down below the 1.15 level it is likely that will be one of those times. It will also more than likely see a massive amount of US dollar strength across the board, because this is the closest thing to the US Dollar Index that a lot of traders have, as the euro is almost 60% of that index. Expect choppy volatility, but I still think that it is only a matter of time before I am a seller of the euro again. The only question now is whether or not it is on a breakdown below the last couple of candlesticks, or if it is some type of rally that I can short.