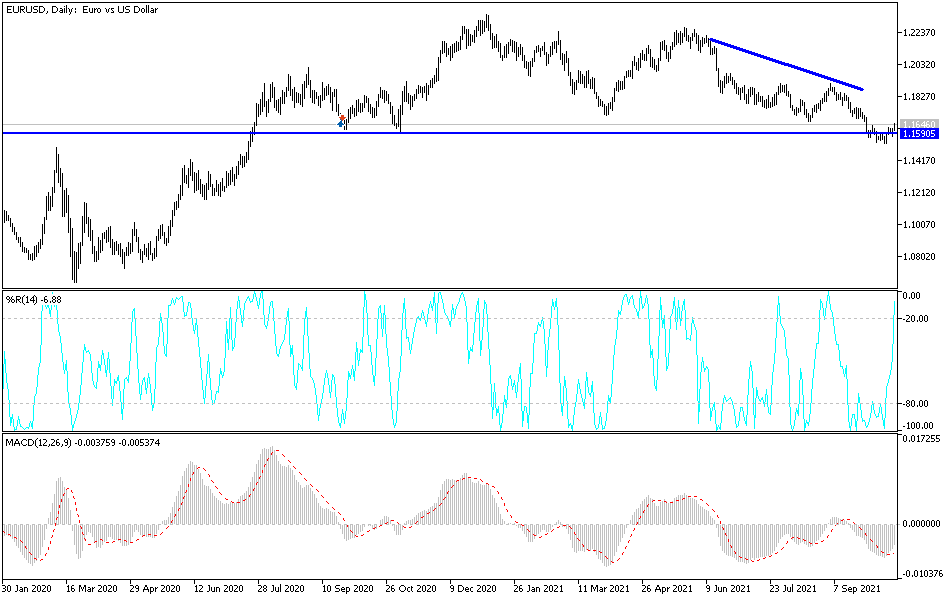

The euro initially fell on Monday but turned around to show signs of stability again. If we can break above the 1.1650 level, it is likely that we will go looking towards the 50-day EMA above. I suspect that the market is very unlikely to be able to just shoot straight up in the air, but I do think that it is only a matter of time before the sellers will come back in. That being said, you should also pay close attention to the idea of the US dollar driving this more than anything else, because the euro represents a part of the world that has some catching up to do.

If we were to turn around and break down below the 1.1575 handle, then we could go looking towards the lows again, which is closer to the 1.1530 level. I think that the 1.15 level underneath there is a bit of a “floor in the market”, and you need to be cognizant of the fact that any breach of that level will be extraordinarily bearish. The market breaking down below there could very well send the US dollar higher against almost everything. That being said, you should pay close attention to the US Dollar Index, because it is so highly influenced by this currency, and can give you a general “up or down” look at the dollar itself.

Expect volatility and a lot of choppiness, but I do think that given enough time we will probably see some type of bigger move. You are looking for a relatively impulsive candlestick, like we had on Wednesday in this market. That does suggest that we are trying to turn things around, but a lot of it is going to come down to interest rates. Interest rates in the European continent did shoot straight up in the air, so it makes sense that the euro could follow right along, and it will come down to whether or not we have any type of follow-through. The 50-day EMA above will be a target and breaking above there could send this market even higher. I think this is a market that will be choppy more than anything else, so look at short-term charts for clues.