Bullish View

Buy the EUR/USD and set a take-profit at 1.1715 (50% retracement).

Add a stop-loss at 1.1600.

Timeline: 2 days.

Bearish View

Set a sell-stop at 1.1615 and a take-profit at 1.1550.

Add a stop-loss at 1.1700.

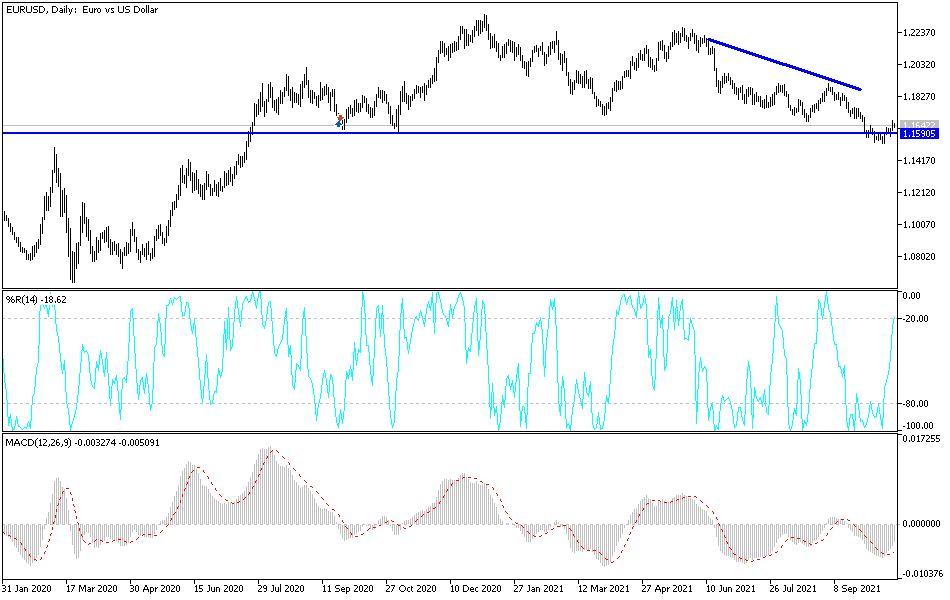

The EUR/USD price retreated as investors reflected on the relatively weak US housing starts and building permits data. The pair is trading at 1.1637, which is slightly below Tuesday’s high of 1.1670.

US Housing Starts and EU Inflation Data

The US housing market has had a strong recovery during the pandemic. Demand for homes in most cities has risen, which has pushed prices to record highs. This performance is mostly because interest rates are at record lows and people have made significant savings during the pandemic. Also, the pandemic pushed more people to have a desire for a second home.

Now, there are signs that the industry’s growth is cooling. Data published by the Census Bureau showed that housing starts declined by 1.6% in September. Precisely, they declined from more than 1.58 million to 1.55 million. Meanwhile, building permits declined by 7.7% from 1.72 million to 1.589 million. This trend will likely continue as home buyers start pricing in higher interest rates.

The biggest catalyst for the EUR/USD will be the latest EU Consumer Price Index (CPI) data that will come out in the morning session. The data are expected to show that the headline CPI rose from 0.4% in August to 0.5% in September. On a year-on-year basis, the prices are expected to have risen by 3.4%, which is significantly higher than the European Central Bank (ECB) target of 2.0%.

Still, Europe’s consumer inflation will keep rising as the cost of energy keeps rising. In the past few weeks, the price of gas has jumped to an all-time high. Despite assurances by Putin, the situation will likely get worse since Gazprom has said it will not pump gas through Ukraine in November.

EUR/USD Forecast

The EUR/USD pair has been in a strong bullish trend in the past few days. It has risen by more than 1% from its lowest level in October. The pair has also managed to move above the bullish flag pattern that is shown in black. A bullish flag is usually a positive sign for an asset. It is now trading between the 23.6% and 38.2% Fibonacci retracement levels.

Therefore, despite the pullback, the pair will likely keep rising as bulls target the 50% retracement level at 1.1716. This view will be invalidated if the price drops below the 23.6% retracement level at 1.1615.