The EUR/USD pair's rebound attempts, which reached the 1.1667 resistance level, quickly evaporated and returned to settle below the 1.1600 support. This move comes amid the euro’s loss of necessary momentum to continue the correction. In the United States of America, factors that affect any gains made by the most popular currency pair in the Forex market will remain.

The euro has benefited from a supportive global market environment and the dollar has weakened in recent weeks, although domestic factors could put a fresh burden on the EUR/USD over the coming days just as Fed policy risks begin to loom in the first week of next month. Next Thursday's 12:45 am ECB policy decision and 13:30 press conference with Governor Christine Lagarde have gained significance since the September announcement because the bond markets have sold off heavily. This has sharply raised government borrowing costs around the world in recent weeks as investors increasingly bet that a prolonged period of high inflation will cause many central banks including the European Central Bank to start raising interest rates next year.

The problem for the ECB, says Marco Valli, chief European economist at UniCredit, is that a rate increase within a year does not appear to be consistent with the central bank's view on inflation and guidance on interest rates.

While inflation has accelerated sharply in recent months and is widely expected to remain elevated in the Eurozone and elsewhere over the coming months, the European Central Bank's policy directive rules out any change in interest rates until the bank forecasts inflation at its 2% identical target.

The press conference will provide a good opportunity for Lagarde to point out that pricing the high probability of a rate hike by the end of 2022 is not in line with the central bank's interest rate guidance. Vale added that the European Central Bank was still on track to end its environmental protection program in March.

After nearly a decade of very low inflation pressures in Europe, the European Central Bank may be one of the least likely central banks to realize that a rate hike may be necessary any time soon, certainly in the latter half of 2022, while recent Frankfurt guidance made clear that It will likely resist any "unjustified tightening" of financial conditions such as those caused by rising bond yields.

The European Central Bank's current policy guidelines and its historic struggle against inflation may mean that it is very likely that you will be dealing with market reactions this Thursday to interest rates, which means that this week's decision could pose a risk to the price of the EUR/USD.

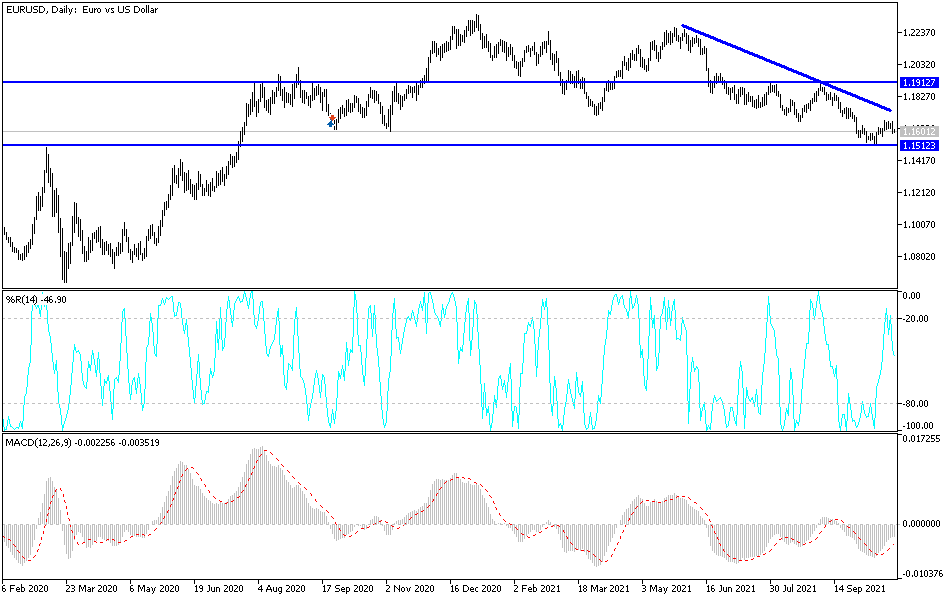

Technical analysis of the pair

On the daily chart, if the EUR/USD moves back below the 1.1600 support, the currency pair will return to the vicinity of its bearish channel again, and the bears may move after that to the next support levels at 1.1560 and 1.1480. The 1.1480 level would bring in buyers because it will push the technical indicators to strong oversold levels. On the upside, the 1.2000 psychological resistance will remain crucial for a general bullish trend. But to reach it, the price must first break through the resistance levels 1.1680 and 1.1775.

So far, the general trend of the EUR/USD is still bearish and the currency pair will be affected by the release of US economic data, US consumer confidence and US new home sales.