The European energy crisis and expectations that the US Federal Reserve's policy will be tightened ahead of ECB policy continue to weaken the performance of the EUR/USD. The pair is stable around the support level of 1.1530, where it settled near as of this writing.

The results of recent European economic data confirm the vulnerability of the European economy to the energy crisis and the disruption of supply chains. In contrast, there was a historic shift in the US Federal Reserve's monetary policy stance in June, which continued in September when Chairman Jerome Powell indicated that the Fed could end its quantitative easing program by the middle of next year and possibly raise interest rates in late 2022, with a path of sharp upward inflation and a steady improvement in US jobs.

The September Point chart of FOMC members' expectations indicated that the interest rate could reach 1.75% or more in 2023 and that it is likely to exceed 2% in 2024, a big jump from the September target range of 0% to 0.25%. In contrast, ECB guidelines indicate that there is a high chance that the Eurozone rate will not be raised by 0.50% or at all by then.

Bank of America lowered its forecast for the remainder of 2021 for the EUR/USD to 1.18 by June, 1.16 by September and 1.15 by the end of the year.

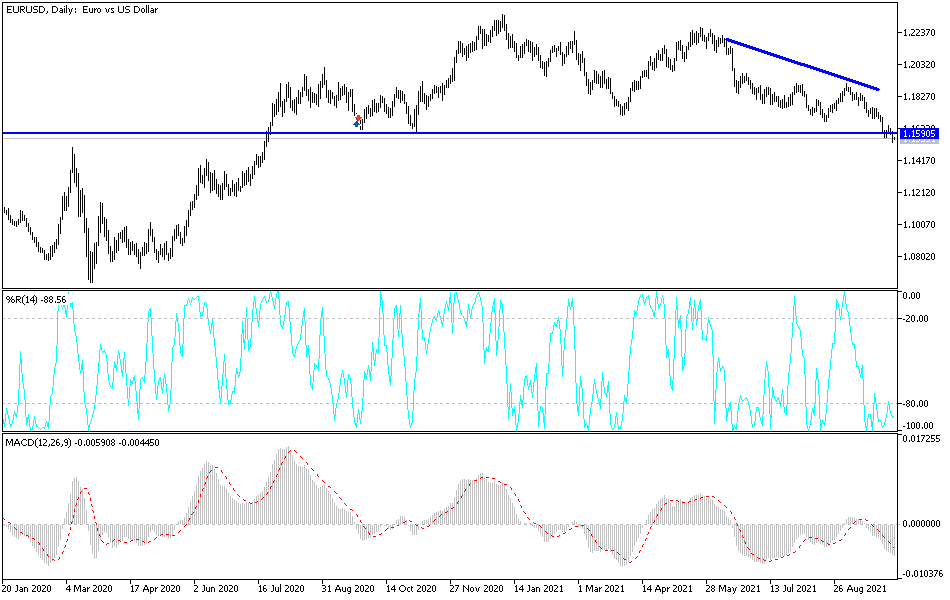

Technical analysis of the pair

The general trend is still bearish, and although technical indicators have shifted towards strong oversold levels, the pressure factors still exist. The closest support levels for the pair are 1.1510, 1.1430 and 1.1380. The last two levels are best for buying and waiting for a rebound to the top of the correction. The EUR/USD pair will remain under downward pressure until US job figures are announced on Friday. Tomorrow's data will directly affect interest expectations and support the dollar or the euro. On the upside, psychological resistance 1.2000 will remain the ideal target for bulls to control the perormance. Otherwise, the overall trend of the euro will remain bearish.

German industrial production figures and the number of US jobless claims will be announced on Monday.