The EUR/USD is approaching the psychological support level of 1.1500 ahead of important weekly data, namely US inflation numbers and the FOMC minutes. The US dollar is still strongly supported in the Forex trading market with expectations of imminent tightening of the Fed's policy. Market expectations for a rate hike for the first time by the European Central Bank came largely in recent days in response to high inflation expectations in the Eurozone.

Money markets have moved to fully pricing in a 10-bps rate hike from the European Central Bank by the end of next year, as expectations of policy tightening continue to rise in the face of rising inflation through mid-2021. Expectations are set for this first rally in 2024, which indicates a big move for the euro price forecast. Money market futures see the European Central Bank's December 2022 meeting with a 100% chance of such a move, compared to a nearly 60% chance on Friday. The chance of a September 2022 rate hike is more than 80% versus nearly 50% at the end of last week.

Expectations for higher interest rates in the Eurozone include a higher yield on German 10-year sovereign bonds, which have reached their highest levels since May, and appear to be poised to break through to the highs last seen in 2019.

But some economists do not see such dynamics underway in the Eurozone, and therefore the ECB's expectations for rate hikes will have limits, if correct. Accordingly, Elias Haddad, chief currency strategist at the Commonwealth Bank of Australia, says: “Unlike the Bank of England, it is clear that the ECB will be looking to override the current inflation in the Eurozone. As such, real bond yields in the eurozone could turn more negative and undermine the euro.”

European Central Bank President Christine Lagarde said last week that the ECB "should not overreact to supply shortages or high energy prices."

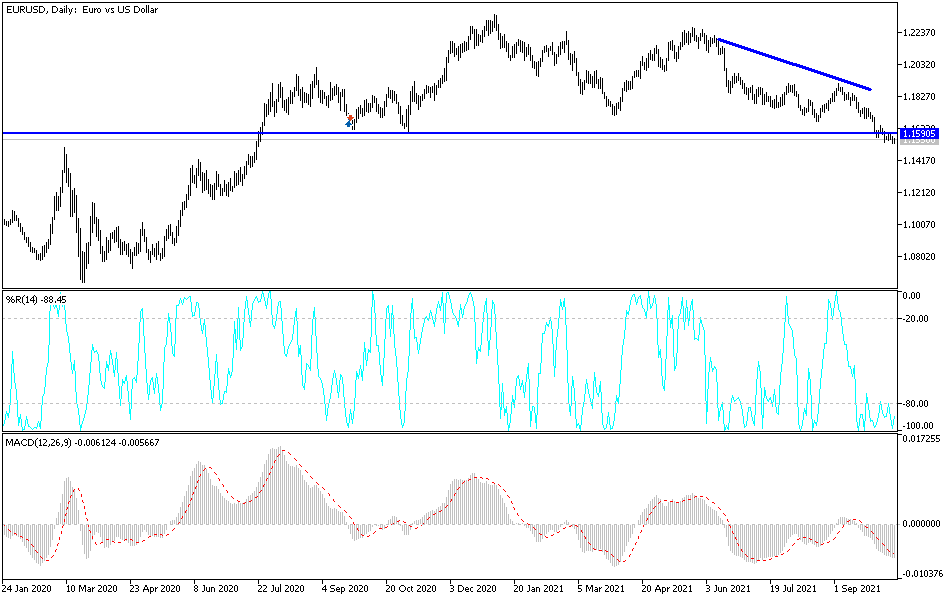

Technical analysis of the pair

The bears do not care about the movement of technical indicators towards strong oversold levels. Therefore, the EUR/USD currency pair is liable to continue being bearish if the dollar gains more momentum from the positive US economic data this week, and the slowdown in the European economy will continue. Even if that happens, the next support targets will be 1.1485, 1.1420 and 1.1355, which could be the best levels for buying the pair and waiting for a rebound. The complete upward correction of the currency pair depends on a movement towards the 1.2000 resistance level; otherwise the general trend of the EUR/USD will remain bearish.

The industrial production rate for the Eurozone will be announced, then the US inflation figures, ending with the announcement of the minutes of the last meeting of the US Federal Reserve.