The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

There are a some strong valid long-term trends in the market right now, so it is a good time to be trading to take advantage of that.

Big Picture 17th October 2021

Last week’s Forex market moved in line with some prevailing trends, notably the sharply weakening Japanese yen. Crude oil again moved firmly higher to a new multi-year high price which has boosted oil currencies such as the Canadian dollar and the Norwegian krone. The Australian dollar was the strongest major currency over the past week (closely followed by the Canadian dollar), while the Japanese yen was the weakest.

I wrote in my previous piece last week that the best trades were likely to be short EUR/USD and long WTI Crude Oil in US dollar terms, and long USD/JPY. EUR/USD ended the week 0.21% higher but WTI Crude Oil rose by 3.74% while USD/JPY rose by 1.78%. This produced an averaged win of 1.77%.

Fundamental Analysis & Market Sentiment

The headline takeaways from last week were the continuing rise in the price of crude oil in the face of increased demand and continuing supply chain problems, slightly higher than expected US CPI (inflation) data showing an annualized rate of 5.4%, and stronger than expected US retail sales. Markets quickly shrugged off the inflation data and moved strongly “risk on” as the week progressed, with stock markets, Bitcoin, and crude oil all rising firmly. Stronger stock markets have been given a tailwind by optimism from analysts and the S&P 500 Index ended the week back above its 50-day moving average and only about one hundred points off its all time high made a few weeks ago. The post-corona “reflation trade” is back on, and we see this reflected in the Forex market with the Australian dollar rising strongly while the Japanese yen devalues. The twist this time is the increasing prospect of supply chain disruptions which can lead to rising valuations and shortages of goods.

Last week saw the global number of confirmed new coronavirus cases fall for the eighth consecutive week after previously rising for more than two months, with deaths lower for the seventh consecutive week. Approximately 47.4% of the global population has now received at least one vaccination. Industry analysts now expect a large majority of the world’s population will receive a vaccine by mid-2022.

The strongest growths in new confirmed coronavirus cases right now are happening in Armenia, Australia, Belarus, Croatia, Egypt, Estonia, Georgia, Laos, Latvia, Lithuania, Moldova, Netherlands, New Zealand, Romania, Russia, Slovakia, the United Kingdom, and the Ukraine.

Technical Analysis

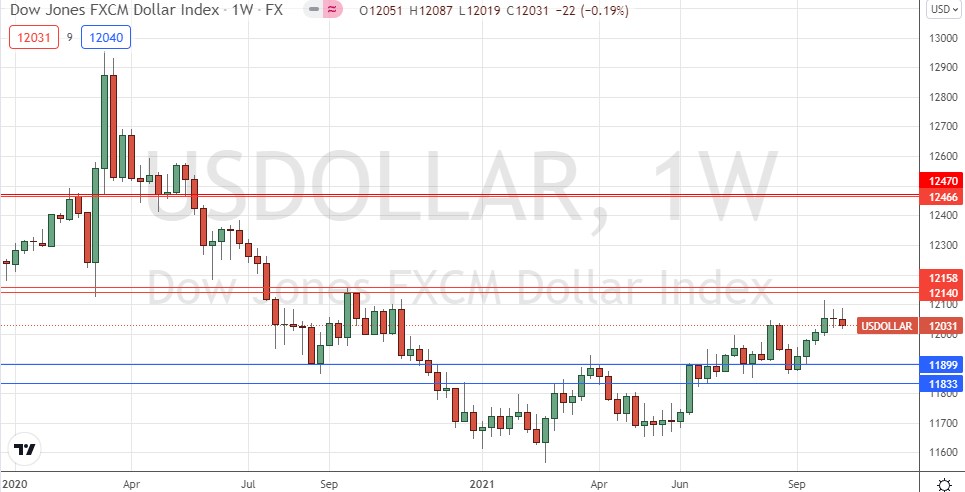

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a bearish pin bar last week after having a few weeks ago rejected the zone of support which I had identified between 11899 and 11833. The price is above the levels from 3 and 6 months ago, which shows that the long-term bullish trend in the greenback is still valid. However, the short-term momentum seems unclear in the USD right now, or maybe even weakly bearish. This suggests that the USD outlook right now is a little uncertain, so the best strategy in the Forex market over the coming week will probably be to look for long trades in strong currencies such as the Canadian and Australian dollars while being short of relatively weak currencies such as the Japanese yen. As the US dollar has little momentum, it can still be OK to trade it in a currency pair if the other currency is interesting.

WTI Crude Oil

WTI Crude Oil closed Friday at a new 7-year high weekly closing price after closing strongly up in each of the previous two weeks. This is a very bullish sign. The price is likely to continue rising over the short term as the global energy supply crisis continues. Bulls should be aware of the potential resistance level shown in the price chart below just above $84.

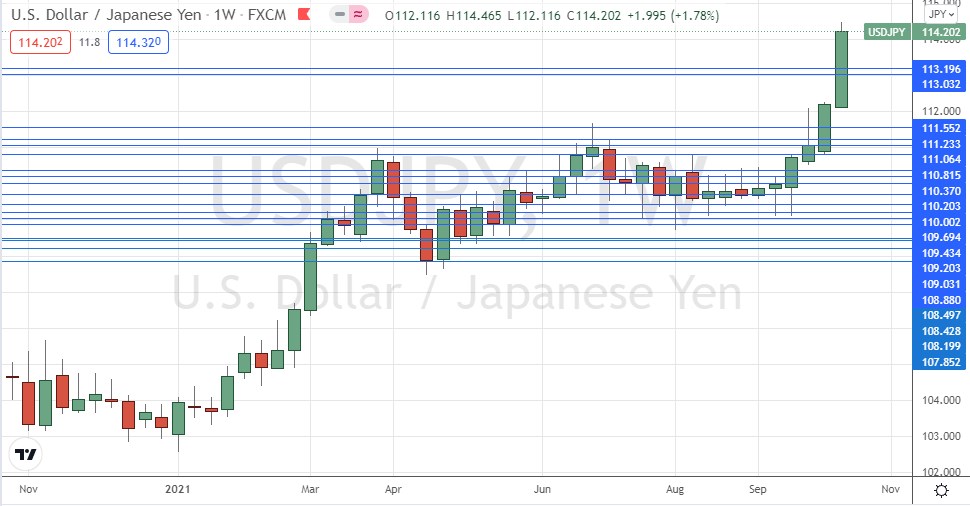

USD/JPY

Following the previous week’s strong and dramatic bullish breakout beyond its recent multi-month price range, this currency pair rose very strongly last week to close at a new 4.5-year high weekly closing price. The range of the weekly candlestick was unusually large, and the price closed near the top of that range. These are bullish signs which suggest trading this pair long is still likely to be a good opportunity to make some profit, especially as there are no key resistance levels until 115.45 although the round number at 115.00 may be an earlier barrier. One word of caution: this price action is due more to weakness in the Japanese yen that strength in the US dollar, so there may also be good opportunities in yen crosses such as AUD/JPY or GBP/JPY.

USD/TRY

The price has been breaking to new record highs for the past three weeks, finally breaking above the round number of 9 Turkish lira to the US dollar. The story here is about the seemingly never-ending depreciation of the Turkish lira which is due partially to the fact that the Turkish central bank is subject to political interference from the presidency which has a very controversial view of monetary policy, and partially due to ongoing structural problems in the Turkish economy.

It can be difficult to trade the Turkish lira as spreads are wide and overnight financing fees (swaps) very high. However, the persistence of the short Turkish lira trend over the years makes it an attractive trade.

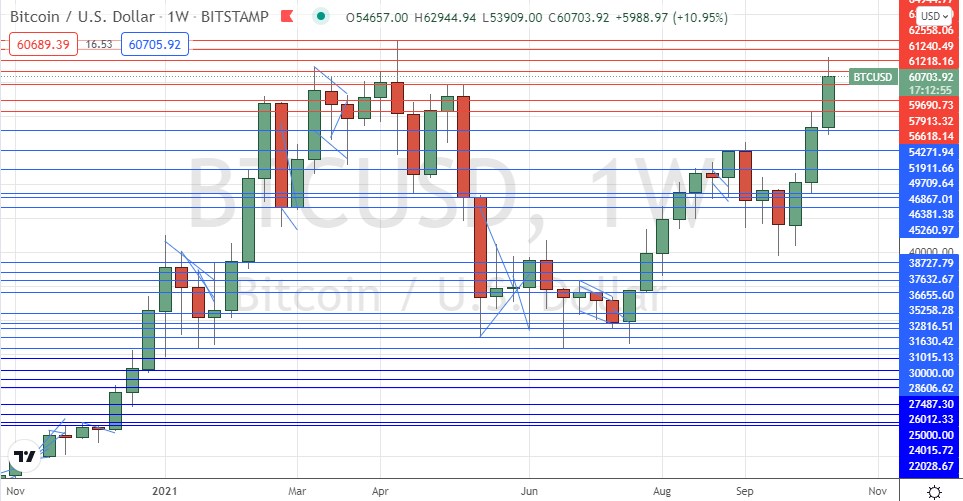

Bitcoin

Bitcoin rose strongly for the third week in a row and is clearly within a long-term bullish trend. If Bitcoin closes in New York tonight above $60k, that will be the all-time high weekly closing price, which will be a bullish sign if it happens.

The price is still a few thousand dollars below its record high price made last April just below $65k. If the price can break above this level, it could rise much higher very quickly.

Bitcoin looks likely to remain a good potential buy in the current “risk off” market environment, but only from strong breakouts of firm bounces at key support levels.

Bottom Line

I see the best opportunities in the financial markets this week as likely to be long of WTI Crude Oil in US dollar terms, and long USD/JPY and USD/TRY.