Bullish View

Set a buy-stop at 1.3630 and a take-profit at 1.3695.

Add a stop-loss at 1.3600.

Timeline: 1-2 days.

Bearish View

- Set a sell-stop at 1.3500 and a take-profit at 1.3400.

- Add a stop-loss at 1.3600.

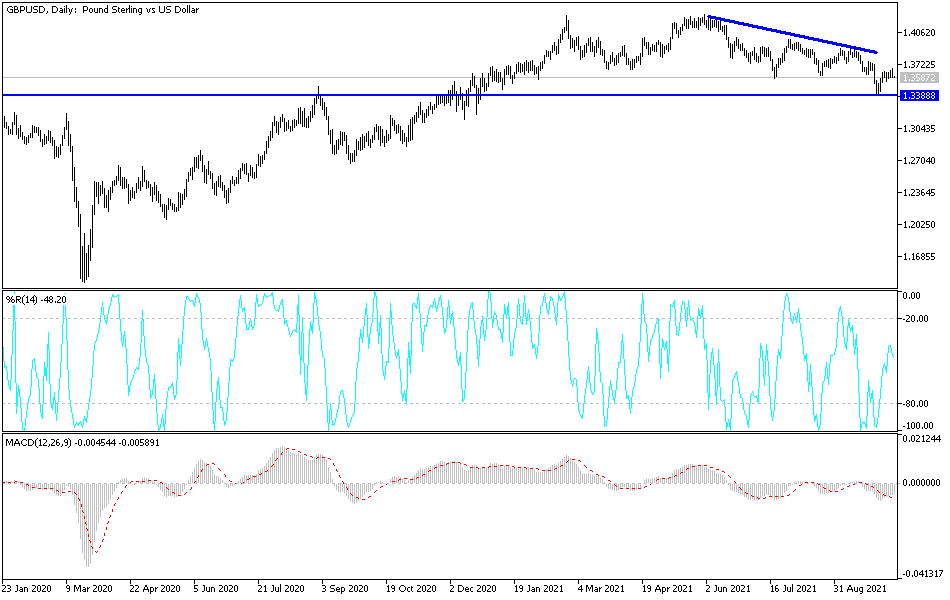

The GBP/USD price retreated slightly in the overnight session as traders waited for the upcoming UK jobs numbers and as the US dollar rebounded. The pair declined to a low of 1.3618, which was slightly below last Friday’s high of 1.3660.

UK Jobs Data Ahead

The GBP/USD declined as investors focused on the rising energy costs as the price of crude oil and natural gas soared. The price of Brent, the global benchmark, rose to a multi-year high of $85 while that of West Texas Intermediate (WTI) rose to more than $81. Similarly, gas prices jumped to a record high even as Russia pledged to stabilize the market.

Still, analysts expect that consumer prices will keep rising because energy is one of the most important component of inflation. While the Bank of England (BOE) expects that inflation will rise to 4%, many analysts are now pricing in a situation where prices jump to more than 6%.

As such, there is a high probability that the BOE will start tightening earlier than expected. Indeed, some BOE members have started hinting that interest rate hikes and quantitative easing will come earlier than expected.

Today, the GBP/USD pair will react to the latest UK jobs numbers that will come out in the morning session. The data is expected to show that the country added more than 243k jobs in three months to August. This will be a significantly higher number than the previous 183k. At the same time, the unemployment rate is expected to drop from 4.65 to 4.55 while average earnings with bonuses are expected to rise by 7.0%.

These numbers will come a few days after the US published the relatively weak jobs numbers on Friday. The US added just 194k jobs in September while the unemployment rate declined. The US will publish the latest JOLTS job openings data later today.

GBP/USD Forecast

The four-hour chart shows that the GBP/USD has been in a tight range in the past few days. The coin has formed an inverted head and shoulders pattern. It has also formed a bullish flag pattern, which is usually a bullish signal. The price is also along a key support since the price is along the lowest level on August 20th.

Therefore, the pair will likely break out higher as bulls target the 50% Fibonacci retracement level at 1.3695.