Bullish View

Buy the GBP/USD and set a take-profit at 1.3700.

Add a stop-loss at 1.3545.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 1.3545 and a take-profit at 1.3450.

Add a stop-loss at 1.3650.

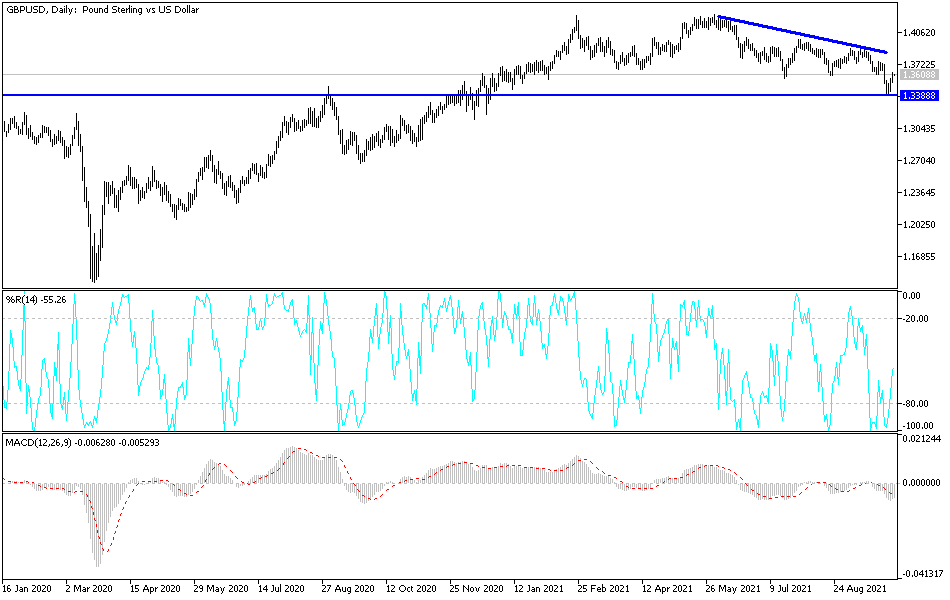

The GBP/USD pair rose for four straight days as investors rushed to buy the dips following last week’s crash. The pair is trading at 1.3605, which is about 1.45% above the lowest level last week.

Rising Bond Yields

The biggest catalyst in the overnight session was the rising bond yields in the United States. In the US, the 10-year bond yield rose to 1.477%, which was the highest level since last week. Similarly, the 30-year yield rose to 2.040%. Meanwhile, in the UK, the 10-year bund yield declined to 1.01%.

The rising bond yields were triggered by the decision by the OPEC+ cartel. After concluding their monthly meeting, the cartel decided to maintain its status quo. This means that they will continue boosting production by about 400k barrels every month. This was a significantly small increase than what analysts were expecting.

Energy is the biggest constituent of inflation around the world. Therefore, there is a likelihood that consumer prices will remain at elevated levels in the next few months. Recent data showed that consumer prices in the UK rose by 3.2% in August.

With oil and gas prices rising, there is a likelihood that the overall inflation will continue rising. The same is true in the United States, where some customers are spending about $5 per gallon of fuel.

The next key catalyst for the GBP/USD will be the Non-Manufacturing PMI numbers from Markit and the Institute of Supply Management (ISM). In the UK, analysts expect the data to show that the Services PMI dropped to 54.6 in September. They also see the Composite PMI falling to 54.1.

Meanwhile, in the United States, the ISM Non-Manufacturing PMI is expected to drop from 61.7 to 60.0. Still, this will be a good number since a PMI above 50 is usually a sign of expansion.

GBP/USD Forecast

The four-hour chart shows that the GBP/USD pair has been in a bullish trend in the past few days. As a result, the pair has managed to move to the 38.2% Fibonacci retracement level. Notably, it has also risen above the 25-day and 50-day moving averages. It has also moved above the pivot point.

Therefore, there is a likelihood that the pair will keep rising later today as bulls target the 50% retracement level at 1.3700.