Bullish View

Buy the GBP/USD pair and set a take-profit at 1.3850.

Add a stop-loss at 1.3720.

Timeline: 1 day.

Bearish View

Set a sell-stop at 1.3750 and a take-profit at 1.3700.

Add a stop-loss at 1.3825.

The GBP/USD pair was little changed as investors reacted to the rising crude oil price and the upcoming US consumer confidence and UK autumn budget. The pair is trading at 1.3778, which is about 0.40% below the highest level this week.

US Consumer Confidence Data

The price of crude oil continued the bullish trend in the overnight session. Brent, the global benchmark, rose to $85 while the West Texas Intermediate (WTI) rose to a seven-year high of more than $84. This happened as investors remained optimistic that demand will keep rising. The price of gasoline also surged by more than 10%.

Therefore, the implication of this is that inflation in the United States and the UK will keep rising. In a statement on Friday, the new Bank of England (BOE) chief economist said that inflation will likely rise to 5% in the coming months. He then predicted that the BOE will start deliberating about tightening in the coming meetings.

Meanwhile, the GBP/USD remained in a tight range after the Wall Street Journal reported that the Fed will likely start tightening in the coming meeting. The statement said that the bank will start winding down its quantitative easing program by about $15 billion per month. Some analysts expect that the Fed will start hiking interest rates earlier than expected.

The next key catalyst for the GBP/USD will be the latest American consumer confidence data that will come out in the American session. Data by the Conference Board is expected to show that confidence declined slightly in October. Consumers are likely worried about the state of inflation and the ongoing supply chain challenges.

The GBP/USD will also react to Rishi Sunak’s autumn budget that will be delivered on Wednesday this week.

GBP/USD Forecast

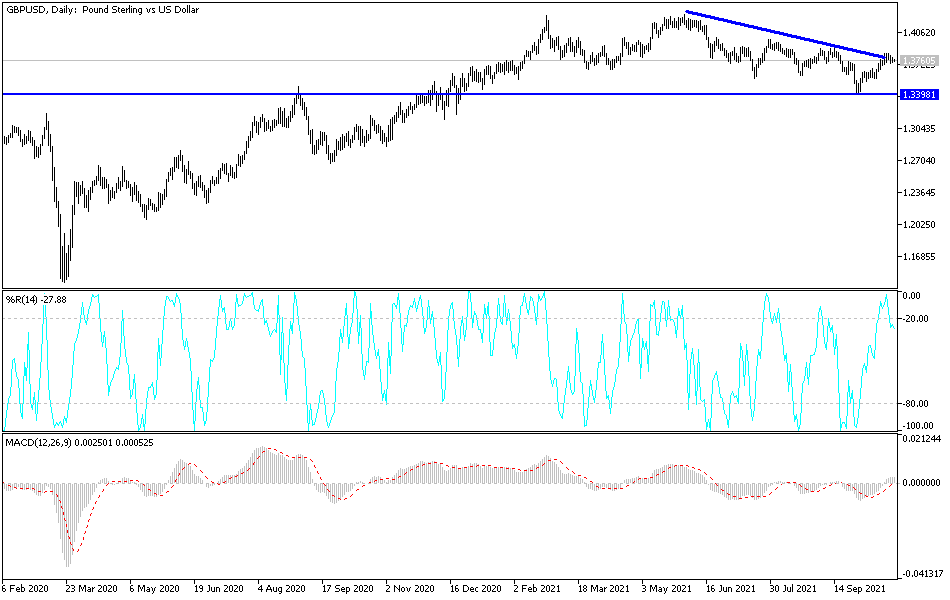

The four-hour chart shows that the GBP/USD pair has been in a bearish trend in the past few days. The pair has fallen by about 0.4% from its highest level this month. It is also along the lower line of the ascending channel pattern that is shown in red. The pair has also declined below the 25-day moving average.

The GBP/USD price is also slightly above the Ichimoku cloud while the two lines of the MACD have continued the bearish trend. Therefore, there is a possibility that the pair will rebound as bulls target the upper side of the channel at around 1.3850. On the flip side, a move below the key support at 1.3720 will invalidate the bullish view.