Last Monday’s GBP/USD signal was not triggered as none of the key levels identified as support or resistance were reached that day.

Today’s GBP/USD Signals

Risk 0.75%.

Trades must be entered between 8am and 5pm London time today.

Short Trade Ideas

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3852 or 1.3898.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Idea

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3773.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

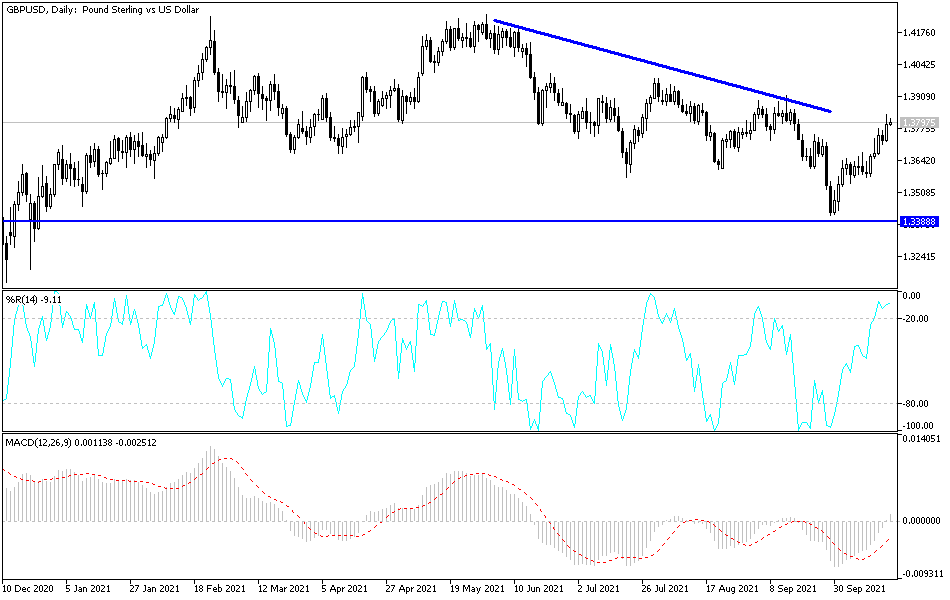

GBP/USD Analysis

I wrote last Monday that if the price could hold up above the support level at about 1.3725 after the London open for an hour or so, we would be likely to see an advance over the day. The level did not hold, and we got a mostly choppy day here as I had expected so this was a good call.

The price advanced yesterday and the price action has looked reasonably bullish ahead of today’s UK CPI (inflation) data release, with the pound showing some strength as the Bank of England warned of resurgent inflation and how it would probably have to be tackled by a rate hike soon. However, data was released earlier today showing that annualized UK inflation is decreasing, with the rate coming in at 3.1% compared to the 3.2% which had been expected. This is a minor undershoot but this data point probably now will delay the prospect of a rate hike, which is likely to remove some strength from the British pound.

The price of this currency pair has so far reacted little to the news, although it has fallen which is a small bearish sign, and the price has a long way to fall below the obvious inflection point at 1.3773. Therefore, if we get two consecutive lower hourly closes below that level during the first half of today’s London session, I would be ready to take a bearish bias on this currency pair.

There is nothing of high importance scheduled today regarding either the GBP or the USD.