Bullish View

Buy the GBP/USD and add a take-profit at 1.3700.

Add a stop-loss at 1.3565 (lower side of the bullish flag).

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 1.3565 and a take-profit at 1.3500.

Add a stop-loss at 1.3630.

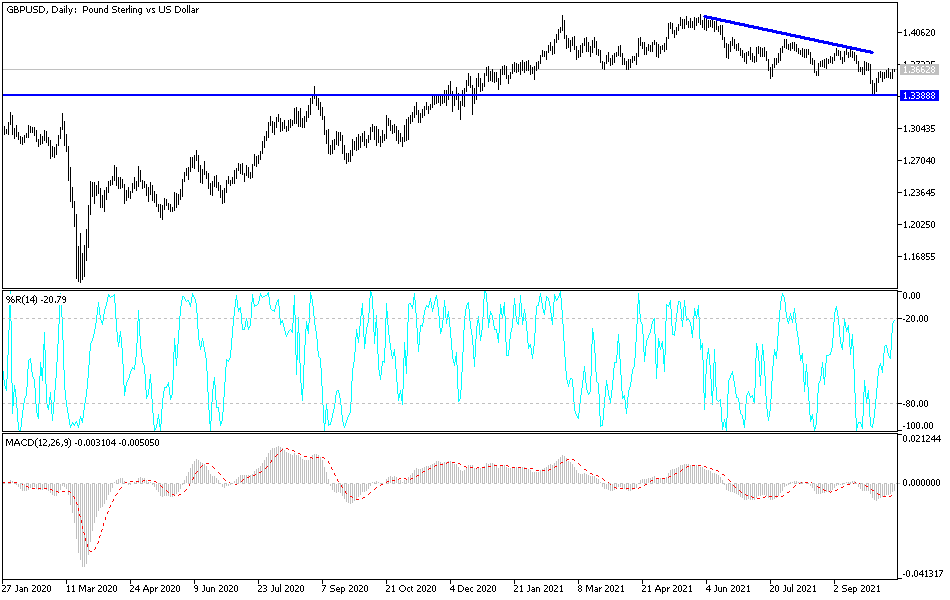

The GBP/USD pair rebounded as the market reacted to the strong UK GDP and American consumer inflation numbers that were published on Wednesday. The pair rose to a high of 1.3647, which was relatively higher than this week’s low of 1.3570.

UK GDP and US Inflation

The UK has been publishing relatively strong numbers recently. On Tuesday, the country’s Office of National Statistics (ONS) published strong jobs numbers. The data showed that the country’s unemployment rate declined to 4.5% in August as the economy reopened. The job growth was driven by the services sector, which includes companies like restaurants and hotels.

On Wednesday, the ONS published strong GDP numbers. The data revealed that the economy rebounded by about 0.4% in August. This growth was also driven by the services sector. At the same time, the UK manufacturing, industrial, and construction output soared.

Meanwhile, the UK inflation is expected to soar as oil and gas prices rise. As such, there is a likelihood that the Consumer Price Index (CPI) will move above the Bank of England’s (BOE) target of 4.0%. As such, investors have started pricing in tightening by the BOE.

The GBP/USD also rose as the European Union made some concessions to prevent a hard border on Northern Ireland. The union said that it was ready to scrap most of the border checks for goods entering Northern Ireland. The UK has insisted that the bloc will need to renegotiate some of the exit clauses.

Meanwhile, across the pond, data showed that the country’s inflation is rising. The headline CPI jumped to 5.4% in September. Later today, the US will publish the latest Producer Price Index (PPI) data. Economists expect the data to show that the headline PPI jumped to 8.7% while core PPI rose to 7.1%.

GBP/USD Forecast

The GBP/USD pair rose slightly in the overnight session. It managed to move from a low of 1.3570 to 1.3650. The pair has formed a bullish flag pattern that is shown in black. It also moved above the 38.2% Fibonacci Retracement level. At the same time, it has jumped above the 25-period and 50-period exponential moving averages.

Therefore, the pair will likely keep rising as bulls target the upper side of the flag pattern at 1.3672. In the longer term, it will likely break out and resume the bullish trend.