Bearish View

Set a sell-stop at 1.3650 (38.2% retracement).

Add a take-profit at 1.3465 (50% retracement).

Timeline: 1-2 days.

Bullish View

Set a buy-stop at 1.3865 and a take-profit at 1.3950.

Add a stop-loss at 1.3750.

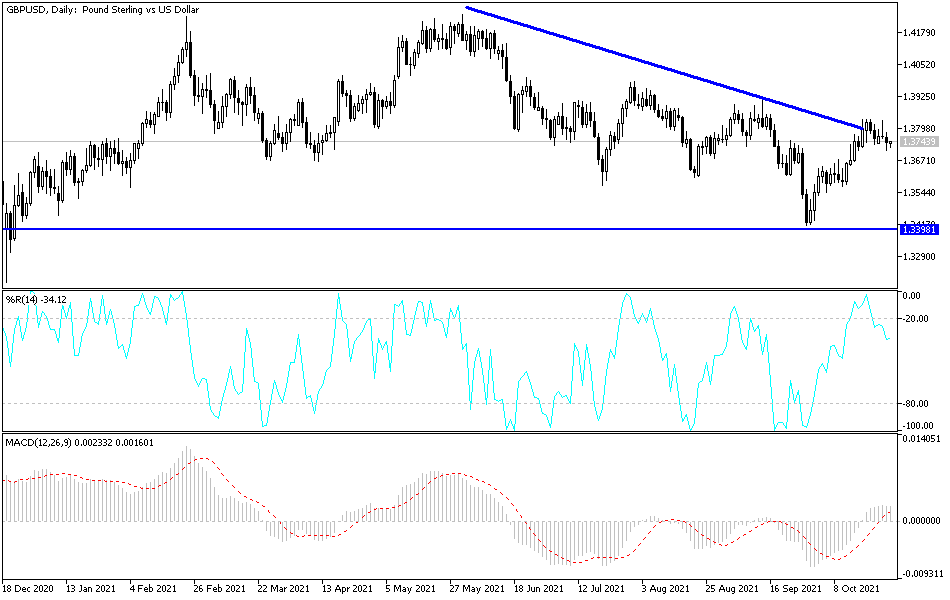

The GBP/USD tilted lower as investors reflected to the budget speech by Rishi Sunak and the relatively strong US durable goods orders. The pair is trading at 1.3723, which was about 0.80% lower than the highest level this week.

UK Budget and US GDP Data

Rishi Sunak, the UK Chancellor, delivered the autumn budget on Wednesday. In it, he announced that he would cut into half business rates for companies in the hospitality, retail, and leisure industries. These were among the most affected companies by the pandemic. The Chancellor also announced that the government will cut taxes on alcohol, air passenger duty on domestic flights, and the universal credit.

The GBP/USD also declined after the US published the latest durable goods orders. The data showed that headline durable goods orders declined by 0.4% in September after rising by 1.3% in the previous month. This decline was better than the median estimate of -1.1%. In the same period, core durable goods orders rose from 0.3% to 0.4%.

Excluding defense, the orders rose by 0.8%. This performance was blamed to the rising costs of items and parts shortages. Indeed, companies like Boeing and Intel warned that the ongoing logjam in global logistics will hurt business for a while. These numbers came a day after the US published strong consumer confidence data and new home sales numbers.

Looking ahead, the GBP/USD pair will react to the latest US GDP number. This will be closely-watched data because it is the first estimate of how the economy performed in the third quarter. Analysts expect the data to show that the economy expanded by 2.7% in Q3, a sharp decline from the previous quarter’s growth of 6.7%.

GBP/USD Forecast

The four-hour chart shows that the GBP/USD pair has been in a bearish trend lately. It has already declined by 3.7% from its highest level this year. The pair is also trading slightly below the upper side of the descending trendline that is shown in red. It has also moved slightly above the 38.2% Fibonacci retracement level. It is also slightly above the 25-day and 50-day moving averages.

Therefore, the pair will likely keep falling as bears targe the 50% retracement level at 1.3466. On the flip side, a move above the descending trendline will invalidate the bearish view.