Last Wednesday’s GBP/USD signal was not triggered as there was no bullish price action when the price first reached the support level identified at $1.3577 that day.

Today’s GBP/USD Signals

Risk 0.75%.

Trades must be taken before 5pm London time today only.

Short Trade Ideas

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3687 or 1.3746.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Idea

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3574.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

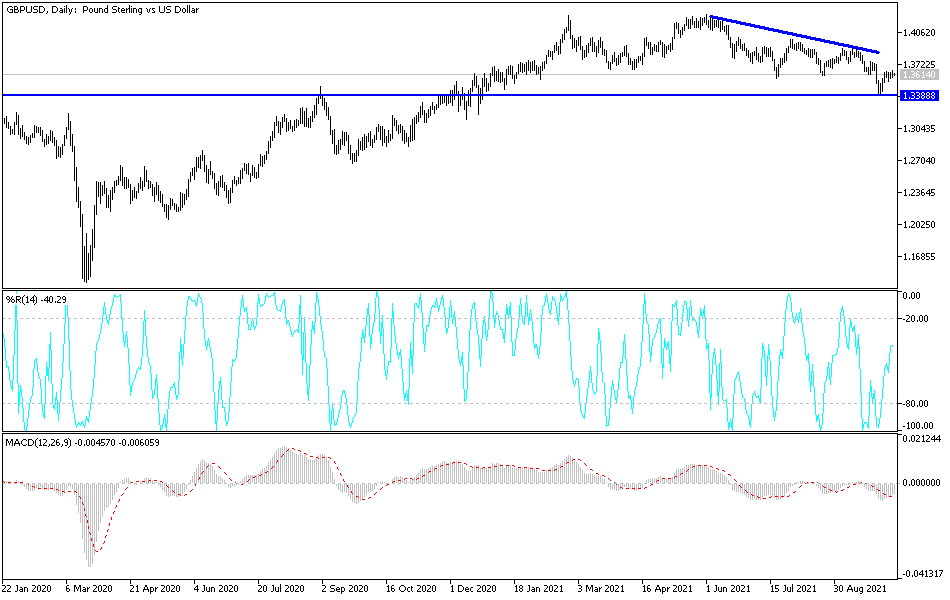

GBP/USD Analysis

I wrote last Wednesday that the US dollar remained strong, but the British pound was holding up relatively well against it. I thought that bullish movements were likely to be more interesting than bearish movements, so I was looking to trade either a bullish bounce at $1.3577 or a strong breakout above $1.3650.

This was not a useful call as the price closed down on the day and easily broke below $1.3577, but it was at least enough to stay out of trouble.

The formerly strong USD lost some tailwind at the end of last week with a disappoint non-farm payrolls release in the USA, while the British pound has firmed up as members of the Bank of England in recent days are publicly hinting that the bank will need to raise interest rates soon to head off inflationary pressure. This has helped the price continue to rise gently here, in a wider market environment where risk is bid again.

Technically, the price has been rising since last Wednesday with a sequence of higher lows and higher highs, with no obvious obstacle to further advances except the resistance level at $1.3687.

The US is on holiday today so trading may become very thin after the first half of today’s London session. Therefore, the best approach will probably be to look for early short-term trades on dips on shorter time frames.

There is nothing of high importance due today regarding either the GBP or the USD. It is a public holiday in the USA today.