The gold markets have fallen a bit during the course of the trading session as we await the jobs number on Friday. One of the biggest drivers of this market will be the Federal Reserve and what it is going to do next. After all, the market is likely to continue to see the inflation situation in the possible tapering situation in the United States as a major question. I believe that we could see the gold market move in reaction to the US dollar more than anything else.

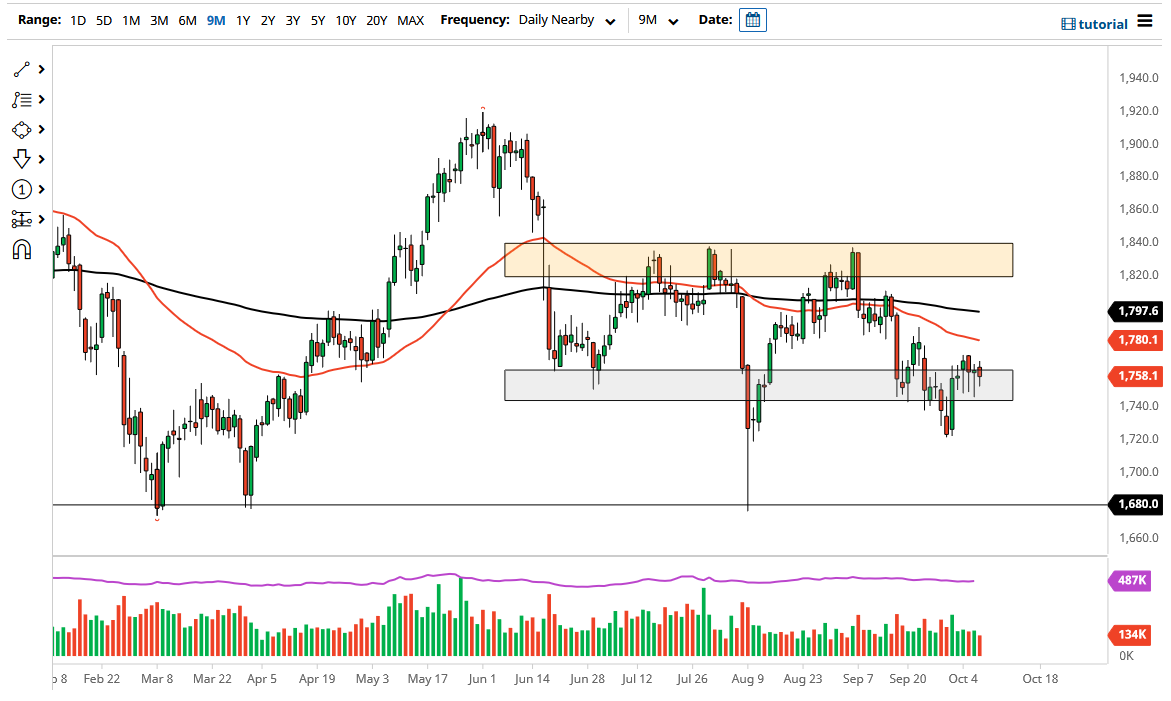

If you look below, there is a significant amount of support all the way down to the $1740 level, so I think a breakdown below that level would be a pretty big deal. At that point, I would anticipate that gold would go crashing towards the $1725 level. That is where we had bounced from previously, and it is worth noting that we formed a massive impulsive candlestick from that level. Since then, we have seen a lot of back and forth momentum, mainly to the upside. It should be noted that perhaps the Thursday candlestick was a little bit more negative than the others, but that does not necessarily mean anything. One would have to believe that there is a certain amount of “position squaring” heading into the jobs report.

If we break above the highs from both Monday and Tuesday, that would validate the hammers, and could send the gold market much higher. At that point I think the first area we go looking towards would be the 50 day EMA. After that, then we would go looking towards the 200 day EMA. It is worth noting that the 200 day EMA sits at roughly $1800, so that of course in and of itself will be interesting as large numbers tend to attract a lot of attention.

Regardless of what happens next, it is very likely that we will continue to see choppy volatility, but now we have the potential of clarity after the jobs report, because traders will start to look to the Federal Reserve and whether or not the tightening will open up the possibility of a strengthening US dollar. This market is ready to move, and I suspect that by the time we get back to work on Monday, we might have a bit more clarity.