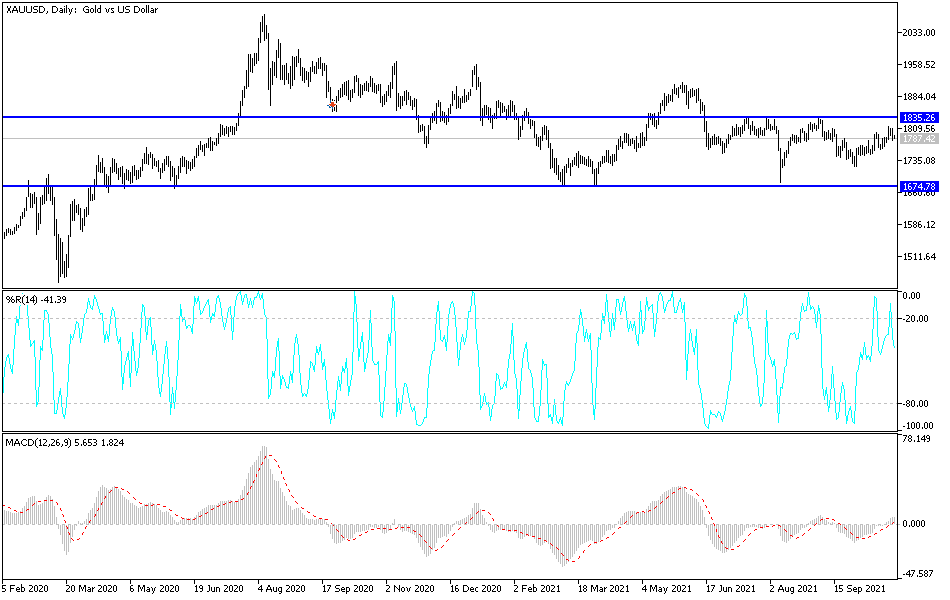

Gold markets have pulled back a bit during the trading session on Tuesday again, as we continue to see a lot of resistance just above. At the end of the day, we started to hang about the 200-day EMA, an indicator that would cause quite a bit of attention to be paid to the market. As long as we are stuck between the 50 day EMA and the 200 day EMA, it is difficult to get overly excited about this market one way or the other. If we can break above the highs of the last couple of days, then it is possible that we could go looking towards the $1835 level. That is an area that had been significant resistance previously, so it is worth paying close attention to it.

The market breaking down below the 50 day EMA underneath could open up a bit of a trapdoor to lower levels, as we would certainly break through a lot of support at that point. The $1750 level underneath would be the target, at least initially. If we break down below that level, then it is likely we go looking towards the $1725 level. I think at that point in time, the market is very likely to continue seeing a lot of volatility, which typically does put quite a bit of negativity into a market. All of that being said, the market is likely to see choppy behavior but at the end of the day, I think this is a market that is in the midst of making a major decision.

As far as making a decision is concerned when it comes to the gold market, you should probably pay close attention to the US Dollar Index, and then of course the 10 year note, because the 10 year yield has a major influence on what happens with gold. If the interest rates continue to rise, that typically works against the value of gold, and as a result the negative correlation is very important to pay close attention to. The next couple of days should continue the overall chop that we have seen, staying in the same relatively tight range as well, so if you are trading this on short-term charts, you have a couple of clear levels from which to trade over the last three days.