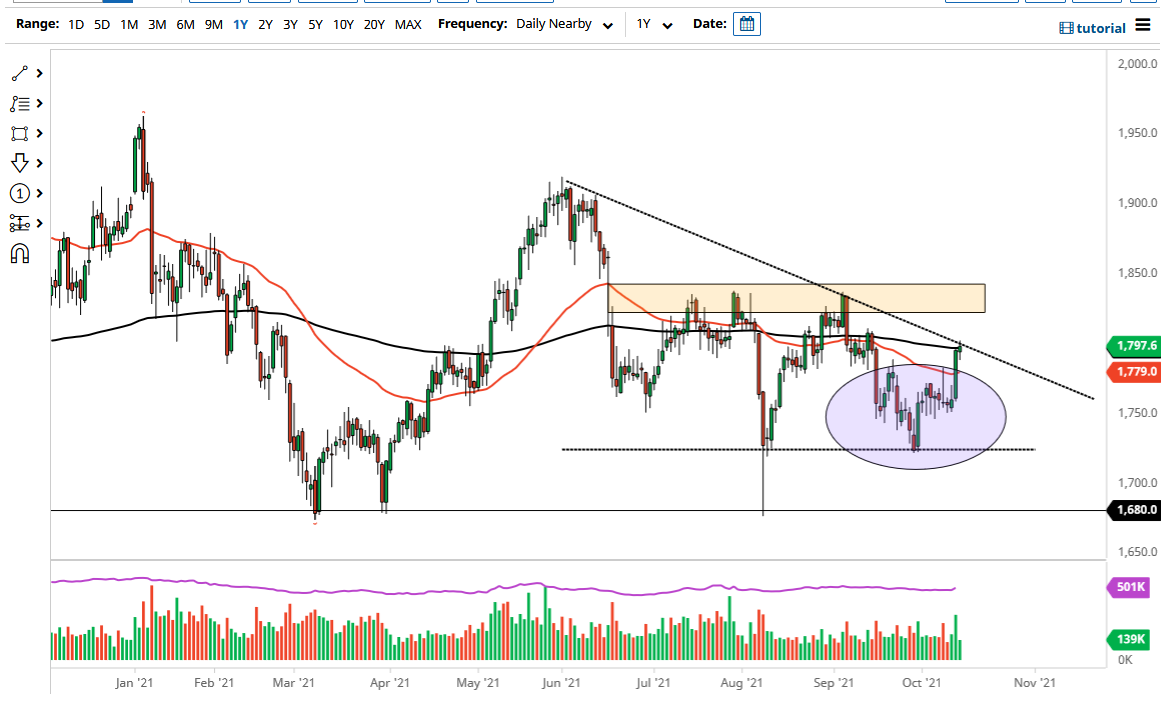

The gold markets have gone back and forth during the course of the session on Thursday, showing a bit of hesitation at an area that of course will be important for multiple reasons. For example, we have the 200 day EMA that is sitting right here and causing a bit of noise, but we also have the $1800 level just above. After that, we also have the downtrend line that sits right in the same area, so it makes a certain amount of sense that the market may hesitate in this vicinity.

Pay close attention to gold, because if we turn around and break down below the bottom of the candlestick from the Thursday session, that could send this market down towards the $1760 level, perhaps even the $1750 level. That is essentially where we took off from during the day on Wednesday, so it would be a complete turnaround. Quite frankly, if we cannot hang on to the gains from Wednesday, I would suggest that perhaps gold is in serious trouble. This is not to say the market pulling back would necessarily be a bad thing, just that if we wipe out the candlestick it would be a bad look.

Ultimately, we could break above the highs of the session and perhaps more importantly, the $1805 level. Breaking that opens up a move to a much bigger area, perhaps the $1835 level. After that, the market would go looking towards the $1900 level, as it would be a major breakout. At that point in time, I suspect that you would see quite a major “risk on” move in this market. Keep in mind that the US dollar has a certain amount of attention paid to it by the gold market, so that should come into the picture as well.

The one thing I think you can count on is a lot of volatility so therefore I would be cautious about my position size until we got a clear indication of where we are going next. I would only add once the trade has worked out in my favor, and therefore slow and steady probably wins the race here. With that, be cautious, but get aggressive once the market starts moving and has proved you correct. In the meantime, I would anticipate a lot of very noisy and choppy short-term trading.