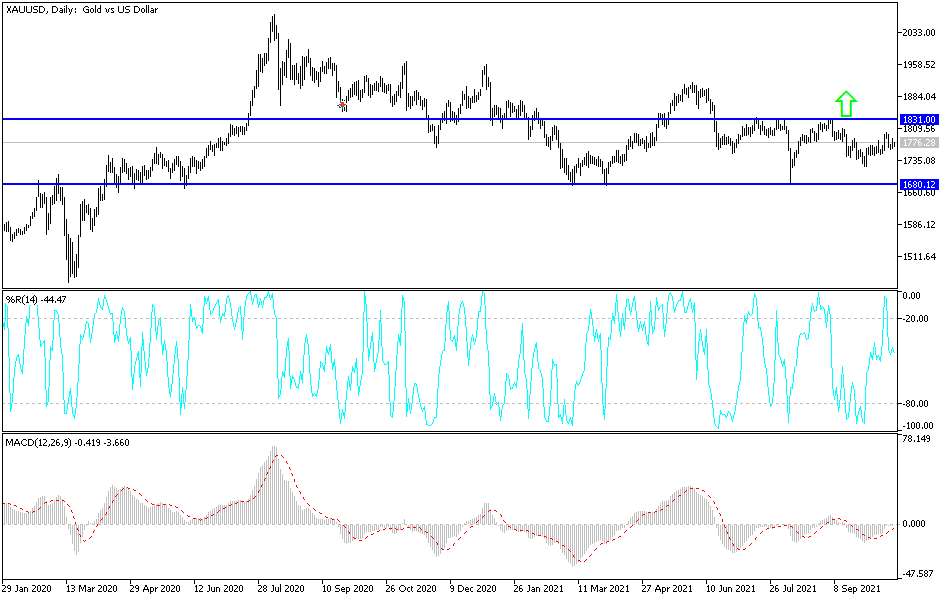

Gold markets rallied significantly early on Tuesday but gave up gains to form a less-than-impressive, shooting star-shaped candlestick. The 50-day EMA sits right in the middle of the week, and that suggests that there will be a lot of interest paid to this market. What is even more interesting is that the 200-day EMA has repelled pricing, and there is a downtrend line that slices right through that general vicinity.

Based upon the way we gave back the early gains, it is likely that we could go looking towards the $1750 level rather quickly. After that, the market could go looking towards the $1725 level, maybe even the $1700 level on the way down to the $1680 handle. That is the trajectory that we have been in for some time, and is very likely that we will continue to see downward pressure. After all, the 10-year note in the United States is offering more yield, so it is toxic for traders to try to own gold due to the fact that the storage costs of gold can be somewhat prohibitive.

On the other hand, if we were to turn around a break above the 200-day EMA and perhaps even clear the $1805 level, then it is likely that we could go much higher. At that juncture, I would anticipate the market going towards the $1835 level, an area that previously had been rather resistive. The market will continue to see a lot of noisy behavior, but at the end of the day, this is a market which, if it broke out to the upside, it is very likely that we would continue to go much higher as it would be a major shift in attitude.

That being said, you have to pay close attention to the US Dollar Index and the yields coming out the 10-year note, because if they start to rise again, that could cause serious problems in this marketplace. The attitude of the markets has certainly been a scenario where every time we rally, sellers come in to squash any type of significant move, and that looks to be very likely to continue. Looking for short-term signs of exhaustion will continue to be the best way to trade this market going forward.