The gold markets initially shot higher but saw quite a bit of selling pressure to turn things around and form a shooting star yet again. This tells you just how much resistance there is above, and it is quite impressive considering just how explosive the move to the upside had been at one point. I was watching the five-minute chart, and I can tell you that the turnaround was quite drastic.

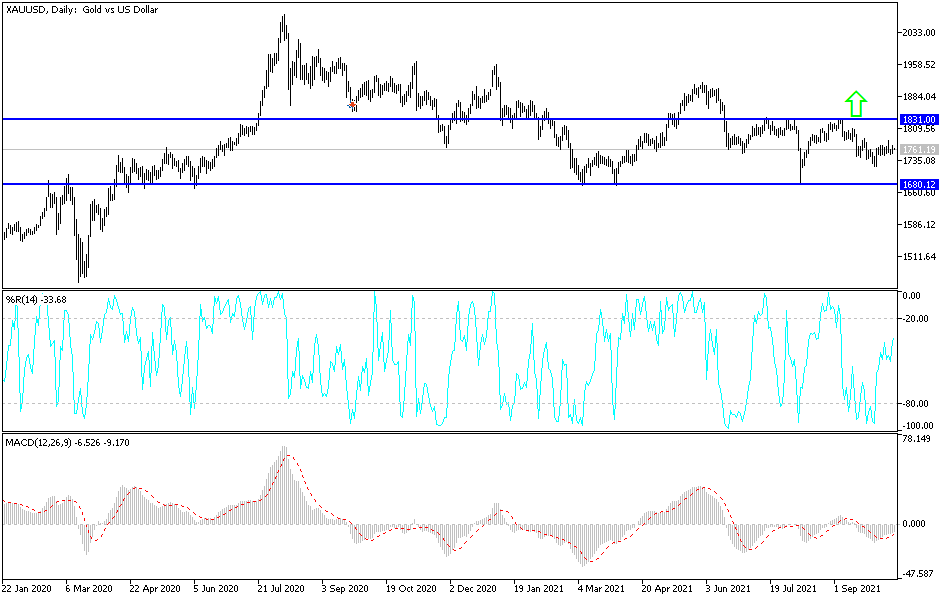

When you look at this chart, I think if we break down below the $1750 level, it is likely that the market could go looking towards lower pricing, perhaps down to the $1725 level. If we break down below there, then it is likely that the market would go looking towards the $1680 level. That is an area that has been massive support previously, so a break down below that would be catastrophic for gold.

Pay close attention to the US dollar, because it has a somewhat negative correlation to the gold market most of the time. If the gold markets start to fall then the US dollar starts to rise, which is the typical way it behaves. If we were to rally from here, I would likely see the US dollar falling at the same time, and I might consider buying gold on a break above the shooting star from Friday, which was the “knee-jerk reaction” after the jobs number was so poor. That being said, the fact that we continue to see a lot of pushback against the move to the upside suggests to me that we are going to continue to see a lot of sellers out there.

If we did break out above the 200-day EMA, then it is likely that we could go looking towards the $1850 level, which would obviously take a lot of momentum to make that happen. In general, the market is likely to continue seeing choppy behavior, and will favor short-term trading as well. Because of this, I like the idea of playing this set of ranges based upon short-term charts more than anything else. The Tuesday trading session has been a perfect example of what I have been talking about. We shot straight up in the air, and then pulled right back down.