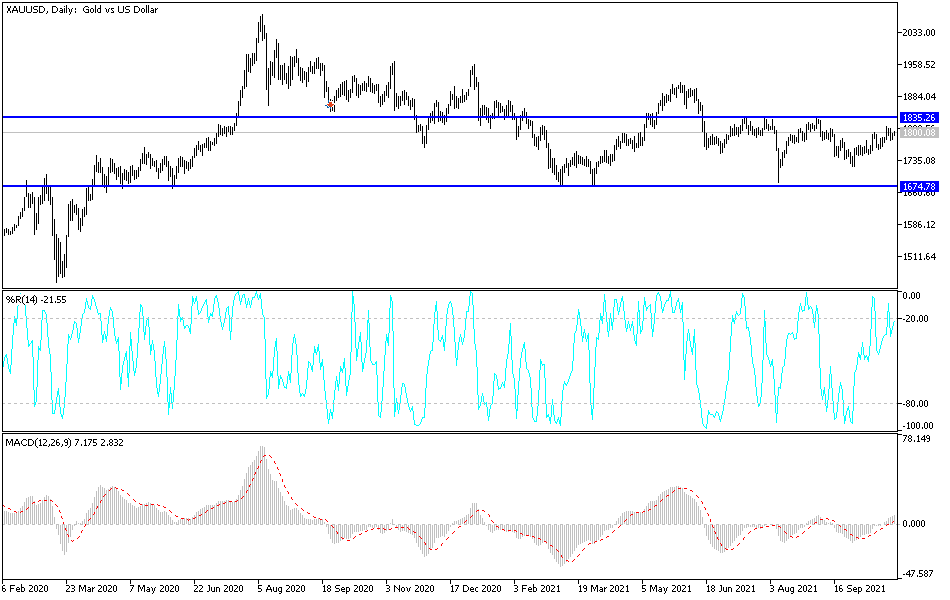

Gold markets fluctuated on Wednesday again as we continue to hang around the 200-day EMA. The 200-day EMA is relatively flat, but it should be noted that the market continues to find buyers on dips, maybe perhaps because the 50-day EMA is attracting a lot of attention all a sudden. The question now is whether or not we have enough momentum to finally break out to the upside, or if we are simply grinding away in a sideways Brownian motion.

The market has formed a little bit of a hammer during the trading session, showing that there is quite a bit of sticky bullish pressure just underneath. If we can break above the highs of the last couple of days, we also are breaking above the top of a downtrend line, so that is worth paying attention to. To the upside, the $1835 level is an area that has offered a lot of resistance, but if we were to clear above that region, the market is likely to become more of a “buy-and-hold” type of situation.

Keep in mind that the interest rates in America can work against the value of gold, as it can become cheaper to own paper than to pay the storage fees for a safety asset that has no yield. Nonetheless, this is a market that I think is starting to squeeze, and it is probably going to have to make a move relatively soon. Once that happens, it will become very obvious as to where we are going next. If it is to the downside, breaking down below the 50-day EMA opens up the $1750 level, followed by the $1725 level.

You should also pay attention to the US Dollar Index because it has a negative correlation to the gold market, as well as other metals. Nonetheless, we are in a very inflationary environment, so it is probably worth noting that most commodities are doing fairly well, although gold has been a bit of a laggard, mainly because of the interest rate situation that I was talking about earlier. Nonetheless, the volatility will give way to a trend, and I think it is only a matter of time before that happens. The next impulsive candlestick should give us the signal that we are looking for.