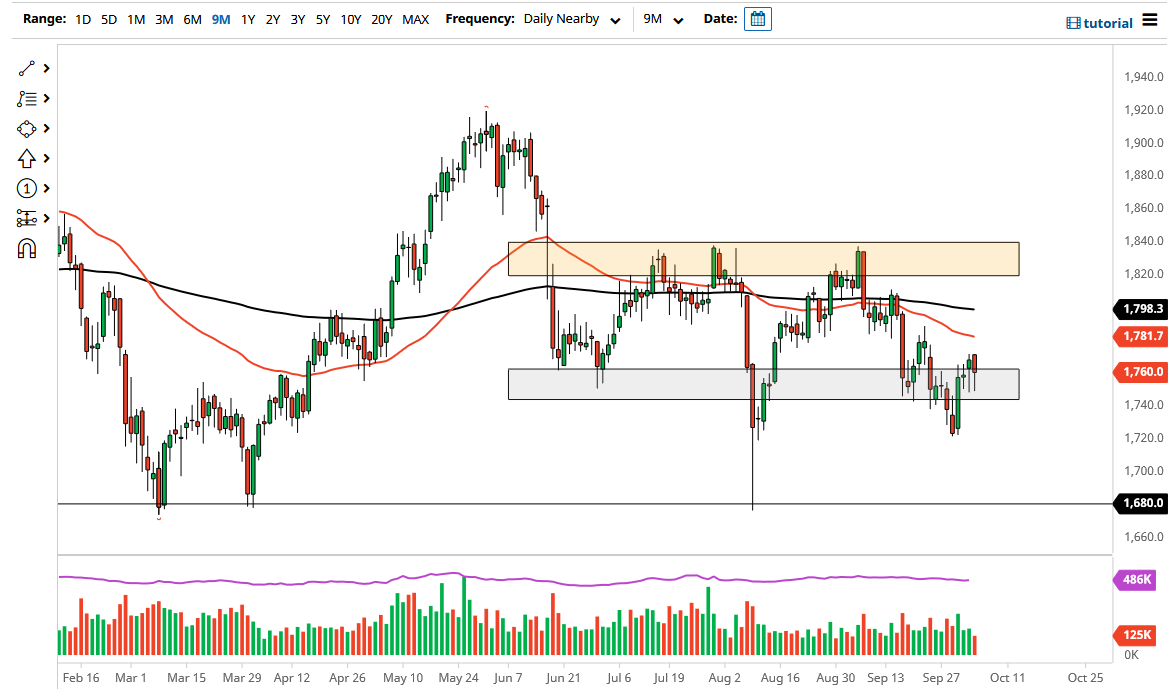

Gold markets sold off rather drastically on Tuesday but recovered quite nicely as it looked like they were going to break down at one point. In fact, in just a few short hours, the market had returned from the absolute lows of the range to form a hammer for the second day in a row. The question now of course is whether or not we can break out to the upside, or if we are simply just killing time.

If we break down below the bottom of the past couple of candlesticks, then I think the market is likely to go looking towards the $1750 level, perhaps even down to the $1725 level. That is where we had bounced from previously, and breaking that would be catastrophic for the gold market. Keep in mind that a lot of this comes down to the interest rates coming out of America and whether or not they are rising enough to provide a little bit of a “real rate of return.” That is essentially when you get paid to hold paper above the inflation rate.

If we turn around and break above the top of the last couple of candlesticks, it is likely that we will go looking towards the 50-day EMA which is closer to the $1780 level. After that, the market would go looking towards the 200-day EMA which sits just below the $1800 level. The $1800 level is a large, round, psychologically significant figure, and an area where we had sold off from. The market clearly looks as if it is trying to make a move, but right now we do not have the breakout or the breakdown necessary to put a lot of money to work.

Based upon the action of the last couple of days, it certainly looks as if gold is trying to save itself. Nonetheless, I think the only thing you can count on when it comes to gold is the fact that it is going to be very choppy, so you need to be cautious with your position size until you get some type of confirmation as to which direction we are heading. At this point, I think we are probably going to chop around and kill a lot of time between now and the jobs number on Friday anyway.