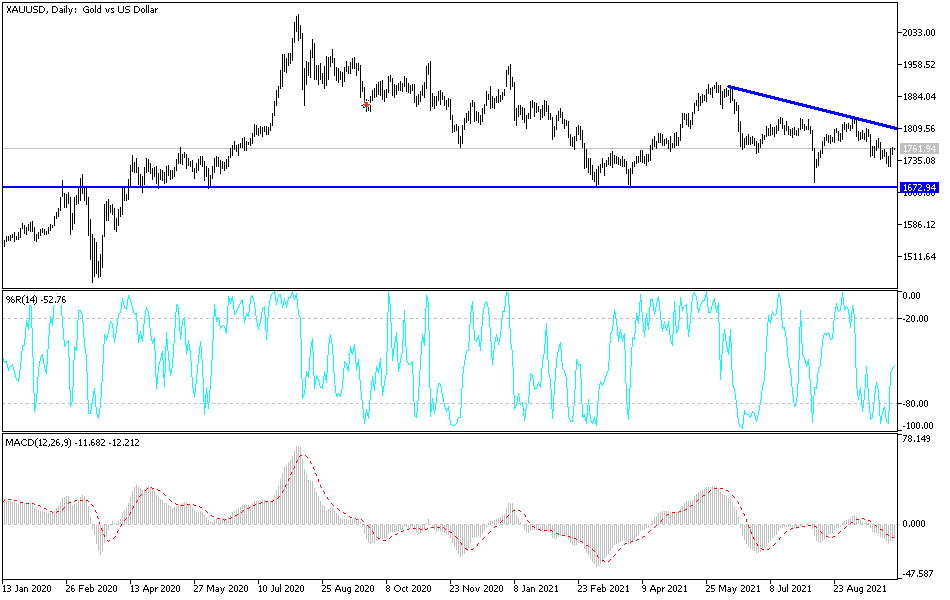

Gold markets went back and forth on Friday, showing signs of exhaustion after the massive bullish candlestick that we formed on Thursday. This is interesting, because after the massive move, one would have to think that the fact that the market has sat still suggests that the upside of gold is somewhat limited. In fact, that is essentially what I am counting on: looking for some type of exhaustion that I can start selling again.

The market breaking down below the bottom of the candlestick from Friday is reason enough for me to start shorting, especially if the interest rates in America start rising again. At that point, the market very likely will go looking towards the lows of the massive candlestick on Thursday, although it may not get there right away. It might be more of a grind lower. Keep in mind that the 10-year yields will have a huge influence on what happens next.

On the other hand, if we were to turn around and take out the highs of both Thursday and Friday, then the market is likely to go looking towards the next resistance barrier in the form of the 50-day EMA. At that point, I would see more selling pressure likely to get involved as well. The market would also have to see a falling US dollar in order to make that a likely trade. I do believe that the average trader is going to be paying close attention to the negative correlation between the US dollar and gold, as the correlation has held up quite nicely as of late.

To be honest, I do think that even if we get a bit of an extension on a move to the upside, it is going to be very limited. With the uncertainty out there, it certainly makes sense that bonds will continue to attract inflows, and we have the chase for yields in a world that has almost none to be found. With this, I am looking for signs of exhaustion that I can fade more than anything else. I recognize that we could go higher, but I will probably forgo any buying opportunity in the short term and simply wait for a clear path lower.