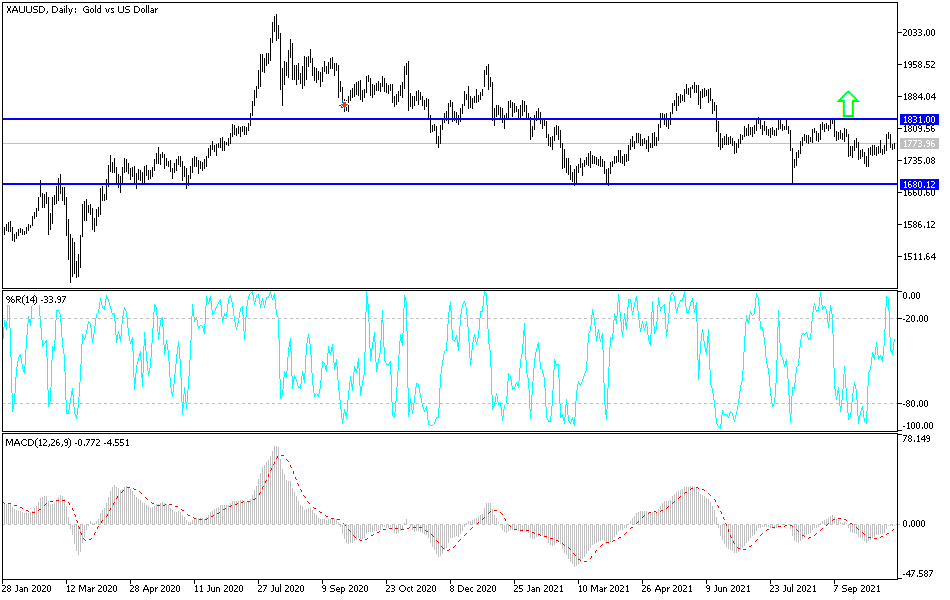

Gold markets fluctuated on Monday, stabilizing after the massive selloff that we had seen during the Friday session. The Friday session had been rather negative, so it is a bit surprising that we have stopped as quickly as we have. That being said, I think the market is likely to see a line of support extending down to the $1750 level, an area that had been important previously. With this being the case, I think it is probably only a matter of time before we get a bit of a bounce. In fact, if we do break above the candlestick for the session on Monday, it is very likely that we will go looking towards the 50-day EMA, perhaps even the 200-day EMA after that. It is also worth noting that there is a major downtrend line that is falling from here, so I think it is only a matter of time before we would see selling pressure going forward.

Keep in mind that the gold market is highly sensitive to interest rates, as rising interest rates in a growth fueled environment is absolutely toxic for gold. Because of this, I like fading rallies that show signs of exhaustion, at least until we break above the $1805 level, which is the top of the overall range that we have been in. If we were to break above there, then the market could very well go much higher. On the other hand, if we break down below the $1750 level, then it is possible that we will go looking towards the $1725 level, and then down to the $1680 level after that. Anything below there will then lead into a massive meltdown.

Pay attention to the US dollar, but more importantly, pay attention to the yields coming out the 10-year note because that is something that will move in a major negative correlation to this market. I think we have a lot of volatility ahead, but really at this point it is worth noting that the overall bigger picture shows that we are in a descending triangle, and that is something worth paying close attention to. Ultimately, this is a market that has to make a bigger move, and we will eventually, but in the meantime, you have to embrace the volatility.