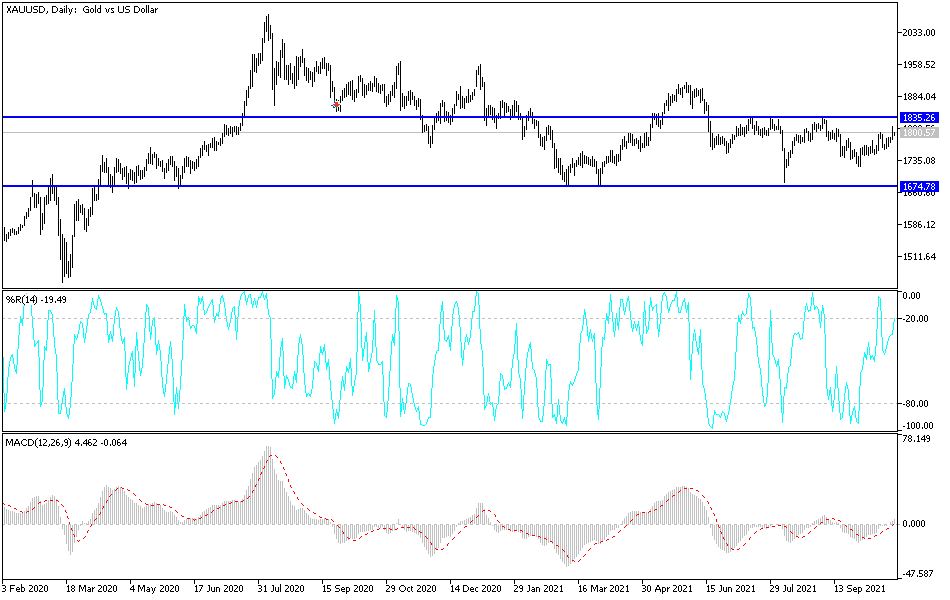

The gold markets rallied rather significantly on Friday to break above the trend line that we have been paying attention to for some time. That being said, the market gave back quite a bit of the gains, in reaction to Jerome Powell reiterating the idea that the Federal Reserve is in fact going to taper. I do not understand why that was an issue, but algorithm traders basically went off the rails at that point. The gold market sold off quite drastically at the US dollar spike, but later in the day we started to stabilize.

Note that the 200-day EMA has also been broken above, although we are closing closer to the confluence of the 200-day EMA and the downtrend line. Furthermore, the $1800 level is an area that would be important to pay attention to as well, so I think at this point it is likely that we will continue to see a lot of downward pressure in the short term. That being said, it will be interesting to see what the gold markets do next, because you will have to pay close attention to the 10-year yield. As yields rise, it does put a lot of negativity on the gold market, just as falling rates would make it positive.

If we break down below the bottom of the candlestick from Friday, it is possible that we could go slicing through the 50-day EMA and go much lower. The market will continue to be very noisy to say the least, and that is probably the one thing you need to be cognizant of. I would be cautious about my position size because the market is very volatile. The shape of the candlestick is a bit of a shooting star, but it is worth noting that later on in the day we started to see a bit of a recovery. This is a market that I think will continue to see a lot of choppy volatility, but it is likely that we would see an impulsive candle that we can eventually get involved with. We do not have it yet, although at one point during the day on Friday it looked as if it was coming.