The gold market rallied significantly on Friday, especially as the weak jobs number shocked the market. Initially, the US dollar got absolutely hammered, as people began to bet that the Federal Reserve will not be able to tighten or taper anytime soon. That being said, the gold market reacted as you would expect, skyrocketing almost immediately.

However, the market found the area near the 50-day EMA to be somewhat problematic, and we have fallen from that level quite hard since then. In fact, most of the spike had been in the first 30 minutes after the announcement. With the US dollar turning around and strengthening, this suggests that traders still believe that the Federal Reserve is going to taper, and that could drive up the value of the greenback. On the other hand, the other thing that works against the value of gold is going to be interest rates rising, as traders prepare for the Federal Reserve to step away from the bond buying market.

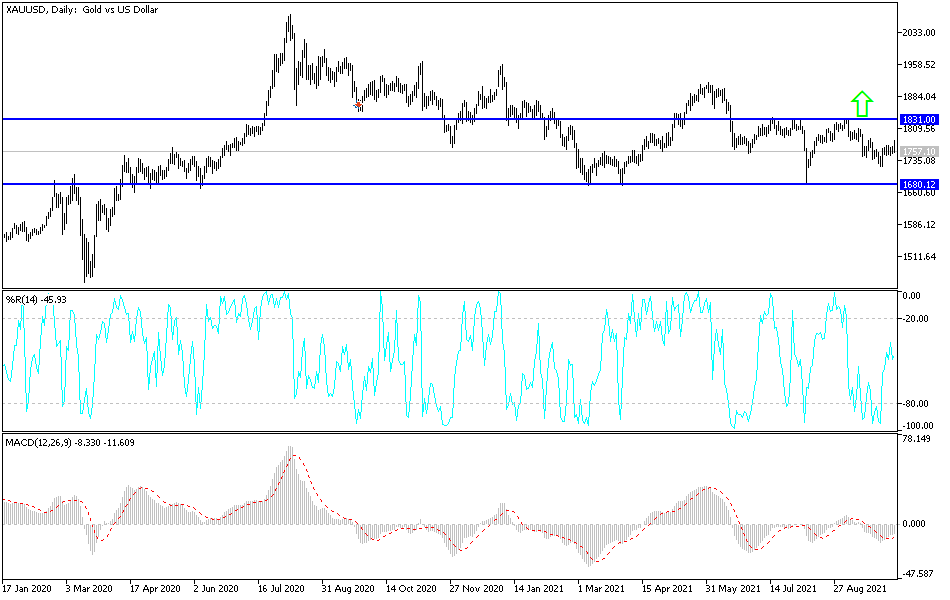

It is much easier to hold paper than it is to store gold, so that makes for a compelling argument that gold will continue to struggle. Quite frankly, the way it reacted after the jobs number was reason enough to convince me, and if we can break down below the $1750 level, then the market is likely to go looking towards the $1725 level, which opens up a move down to the $1680 level. The market certainly looks as if it is trying to break down, but if we were to turn around and reach above the top of the shooting star from the Friday session, then we could go higher to the 200-day EMA which sits just below the $1800 level.

If we can break above the $1800 level, it is likely that we will go looking towards the $1835 level. The $1835 level is an area that has been massive resistance previously, so breaking above that could lead more into the “buy-and-hold” type of situation. That being said, it would take a lot of momentum to make that happen as we would have to slice through multiple resistance barrier areas between now and there. Expect choppiness; I still favor the downside, but recognize that the next $20 or so is going to be difficult.