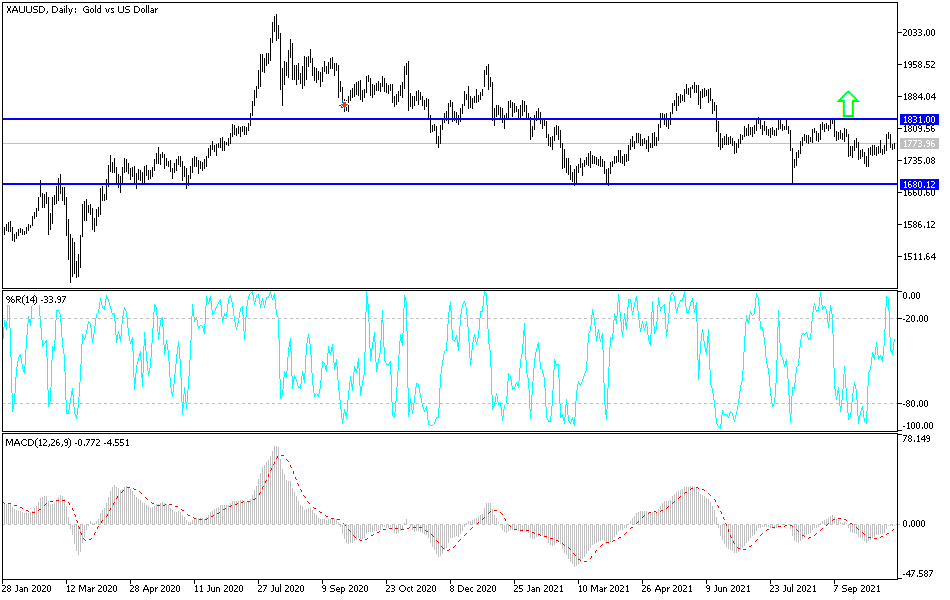

With the beginning of this week’s trading, the price of gold has continued to decline. Gold retreated yesterday towards the $1760 support and swiftly corrected upwards today, settling around $1779 as of this writing. This confirms the strength of the technical level we had recommended. The decline of the US dollar allowed the price of gold to recover higher. Investors are coming back to buy gold with the decline in global financial markets. Currently, the psychological resistance of $1800 is crucial for the bulls, because it may encourage enough buyng to move towards higher levels, the closest of which would be $1819, $1825 and $1845.

Gold prices are heading for a weekly gain of about 0.7%, but they are still down more than 7% YTD 2021. The vicinity of the $1759 support level will bring the gold price back to the neutrality range that has dominated performance since the beginning of this month's trading. I still prefer buying gold from every bearish level.

As for the price of silver, the sister commodity to gold, it also trimmed its notable gains from last week. Accordingly, silver futures fell to $23.225 an ounce. The price of the white metal rose by about 3% last week, reducing its loss in 2021 to less than 13%.

The precious metal is falling on the back of the dollar's strength. The US Dollar Index (DXY), which measures the performance of the US dollar against a basket of six major competing currencies, rose to 94.02, from an opening at 93.94. The index fell 0.3% last week, but is still up by 4.5%. In general, a stronger profit is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors.

As for the US Treasury bond market, the metals market is also hurting, and with the beginning of the week's trading we noticed an increase in the yield on the 10-year Treasury bonds by 0.038% to 1.614%. Yields on one-year notes jumped 0.003% to 0.104%, while yields on 30-year notes fell 0.003% to 2.048%. Higher bond yields are bad for non-yielding bullion because it increases the opportunity cost of investing in metals.

This comes after the Bank of England (BoE) indicated that it may start raising interest rates in the coming months amid rising inflation risks. On the other hand, with Bitcoin making headlines, investors can invest in the cryptocurrency ProShares futures ETF as a hedge. “Bitcoin is approaching its April high again,” Commerz analyst Daniel Pressman said in a note. "In recent months, gold and Bitcoin are often seen as competitors,” he added, “other precious metals are similarly weaker with the start of the new week’s trading. And they seem to be more under the influence of gold nowadays.”

Currently, market analysts believe that the next support level for gold prices may be around $1,757 an ounce.

For other metals, copper futures fell to $4.7145 a pound. Platinum futures fell to $1042.20 an ounce. Palladium futures fell to $1,984 an ounce.